2020 Year-end disclosures

28 Apr 2021

In this blog we take a look at a selection of Insurers’ 2020 Annual Reports and solvency ratios, focussing on the drivers of the changes in ratio and surplus from last year to identify themes in the capital and balance sheet management of insurers over the year.

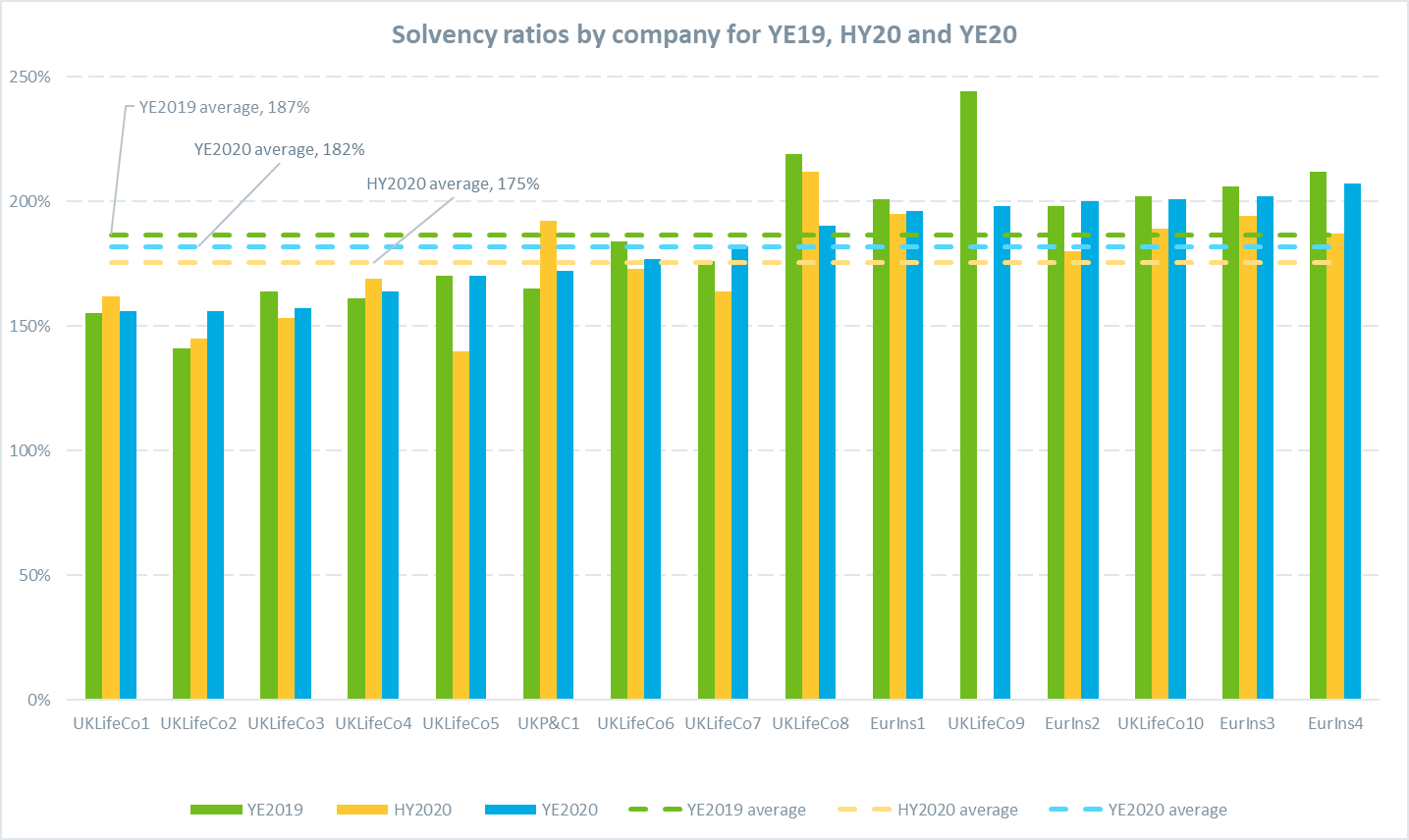

Year-end solvency coverage ratios

We have analysed a sample of fifteen firms, focussing mainly on UK Life Insurers, but we also include some European insurers. For this sample, the average solvency ratio at year end 2020 was 182%, compared to 175% at half-year 2020 and 187% at year end 2019. Considering only the 11 UK Life Insurers in the sample, the solvency ratio at year end 2020 was 175%, compared to 167% at half-year 2020 and 182% at year end 2019.

The overall picture is therefore one of balance sheet resilience from insurers. Ratios clearly declined in the first half of the year, but not by as much as one might have expected and have recovered by the end of 2020 to be close to the levels of end 2019. In fact, some companies (6 of our sample of 15) saw an increase in their solvency ratio.

(Click on the image to enlarge)

Source: Company year-end reports and accounts. See Notes 1 and 2

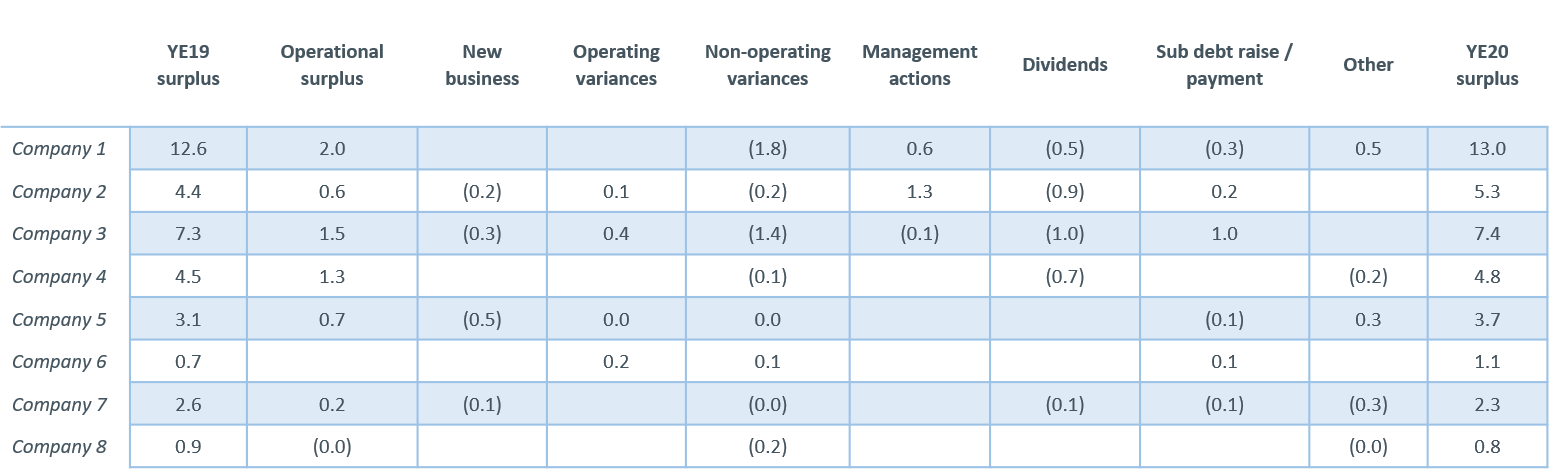

In order to better understand the drivers of the movements, we have analysed what companies have said and, where published, the capital/surplus generation disclosures. As these disclosures are not consistent across the industry, we have used judgement to categorise the sources of movement.

(Click on the image to enlarge)

Source: Company year-end reports and accounts. See Notes 3 and 4

Based on these analyses, we see that the main drivers of increases in capital ratio and surplus, over and above the “operational surplus” (which are broadly releases from the back book), were:

- Management actions

- Issuance of debt / equity

- Longevity reserve releases

And the main drivers of decreases, over and above dividend payments, were:

- Adverse market movements

- New business strain

- Debt / finance costs

Dividends were resumed for most insurers after some decided to put a pause on them last year due to Covid-19 uncertainty. There was also some focus on leverage ratios with Aviva, for example, noting that they will be seeking to reduce debt levels with the proceeds of recent disposals.

Management actions

There were a few different types of management actions over the year, including disposals of non-core blocks of business in order to focus on core offerings. Other actions contributing to improved solvency ratios during 2020 included:

- reinsurance/hedging (e.g. PIC, Rothesay, L&G and Just all increased the proportion of longevity reinsurance);

- changes in asset allocation (e.g. Just’s reduction in equity release mortgage allocation and Phoenix’s increase in illiquid asset allocation); and

- raising of capital (e.g. L&G, Aviva, PIC, Just, Rothesay and Phoenix all raising debt and, in PIC’s case, equity).

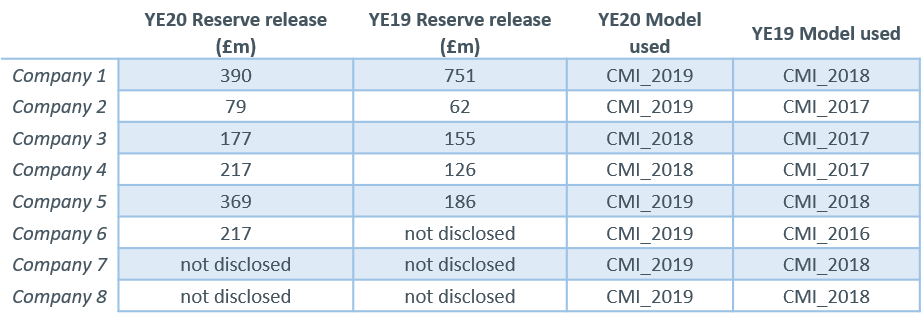

Longevity reserve releases

The contribution of longevity reserve releases continued to be significant for UK annuity writers, albeit the changes to assumptions largely do not yet reflect any potential long-term impacts from Covid-19. As can be seen below, a number of firms have updated to CMI 2019 although the reserve releases may also come from an update to the base mortality tables used.

(Click on the image to enlarge)

Source: Company year-end reports and accounts. See Note 3

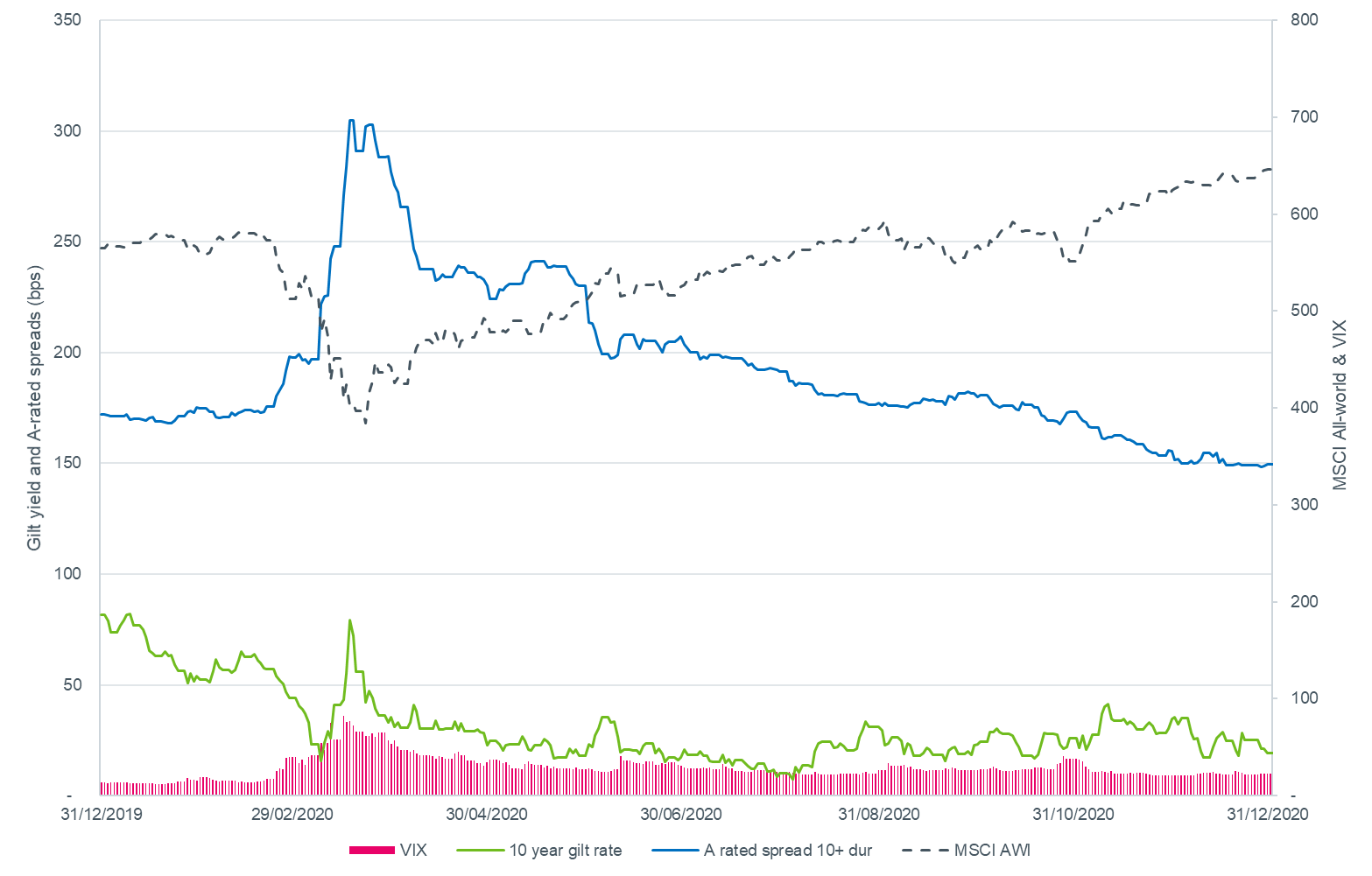

Market movements and credit portfolio

As can be seen from the chart below, during 2020 the value of equities fell and then recovered to higher levels, spreads widened sharply and then reverted to their previous levels and the VIX equity volatility index was at an all-time high when the pandemic was declared. Yields on gilts have decreased from last year and have remained low. Each of these can impact insurers’ balance sheets through the value of future profits on unit-linked business, through impacts on the valuation of options and guarantees on with-profits business, or through impacts on the discount rate used – in particular for annuity business. The degree of impact on the Solvency II balance sheet will depend on the use of the so-called long-term guarantee measures which are designed to help mitigate balance sheet volatility to avoid pro-cyclical behaviour.

(Click on the image to enlarge)

Source: HIS Markit iBoxx, Bloomberg.

There was significant focus in insurers’ disclosures on the credit portfolio and in particular, any default and downgrade experience. No insurers appeared to suffer any significant defaults and downgrades were largely kept to small proportions – particularly downgrades to sub-investment grade, which will have larger impacts due to the matching adjustment rules. The proportion of the credit portfolio suffering downgrades ranged from 4% to 17% for those who disclosed and the proportion of the portfolio downgrading to sub-investment grade ranged from 0.4% to 1%. Overall, this shows relatively positive credit portfolio management within insurers although there is still likely to be further downgrade and, potentially, default experience over the next 12 months or so as government support is expected to be removed.

Looking forward

Whilst market movements have stabilised since the start of the pandemic and there are hopes for return to normal economic activity, insurers will continue to monitor credit risk closely and adjust their portfolios. Capital management will remain in focus for insurers as they use reinsurance, hedging strategies and optimise long-term guarantee measures to improve their balance sheet position. Stress and Scenario Testing has become an even more important tool to help identify and manage the risks within the business and compare to risk appetite – we expect continual development in the approach taken to this. A few insurers have continued to invest in their illiquid asset origination capabilities and we expect increased focus on ESG assets in the next year.

Hymans Robertson has a wealth of investment, risk and capital optimisation and Solvency II experience. Our consultants would be delighted to support you. If you would like more information, please get in touch.

Notes

-

Some of the stated year-end 2019 ratios include the effect of a recalculation of the Transitional Measure on Technical Provisions (TMTP), of which some are “notional” and others are PRA-approved.

-

Caution should be exercised when comparing the Solvency Coverage ratios reported by different firms – the ratios are not intended to reflect or confirm the relative strengths of different firms.

-

The sample of companies varies between charts. For example, ‘Company 1’ in Figure 1 is not the same as ‘Company 1’ in Figure 2.

-

We have allocated the surplus generation drivers provided by insurers into broader categories.

0 comments on this post