FOR UK FINANCIAL ADVISERS

COVID-19 and the markets: a six month snapshot

14 Oct 2020

It’s been an interesting six months: half a year of working from home, Zoom calls, home schooling and very little social contact. Getting back to ‘normal’ feels like taking two steps forward and one step back as the world struggles with a potential second wave. It’s fair to say we’re living with uncertainty in every aspect of our lives.

(click on the image to enlarge)

The graphs highlight just two areas of 2020’s wild and crazy ride. We can see that hotel occupancy rates crashed in March and are still to recover. Interestingly, restaurant bookings seem to mirror different countries’ approaches to getting back to normal: see how Germany’s slow, steady approach to opening back up contrasts with peaks and troughs of the UK’s Eat Out to Help Out scheme.

But what does that mean for Financial Advisors and their clients?

(Click on the image to enlarge)

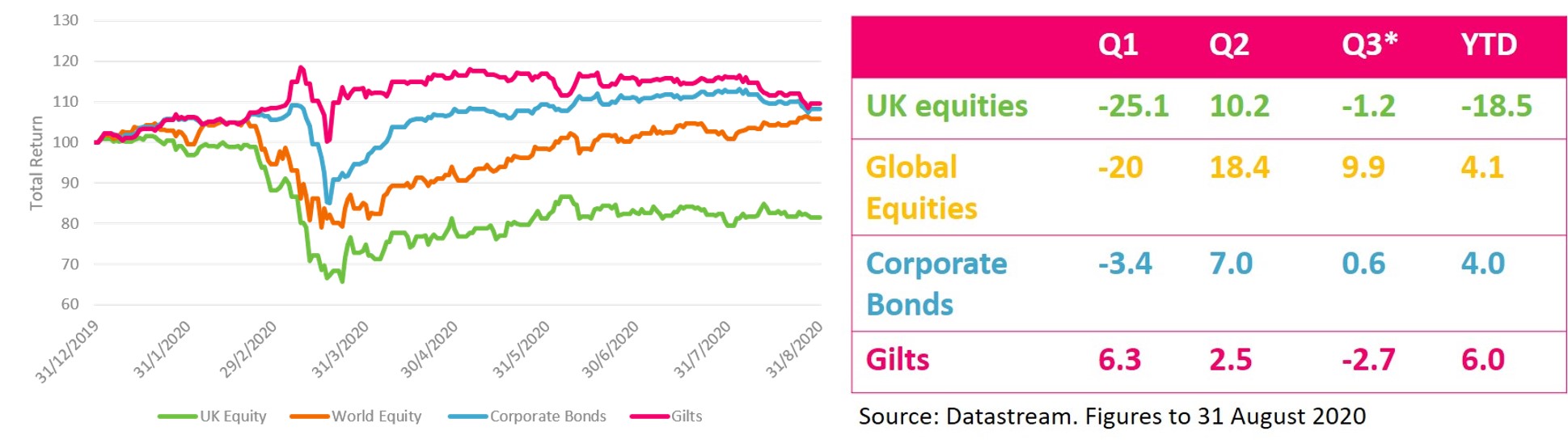

The markets paint a much brighter picture than we were reporting in April. Most asset classes have bounced back after that huge Q1 drop and are now in positive territory with the markets focusing on the positives, particularly optimism around a potential vaccine and the ongoing commitment to monetary policies from the central banks.

Global equities have been particularly well-supported by technology stocks, so the US has done really well. Gilts are slightly ahead too – with the real winners here being those who took the plunge and re-balanced in April.

But the odd one out is UK equities, which have lagged behind the rest of the world. COVID-19 obviously plays a part in this, but it’s far from being the whole picture – factors such as the increasingly high chances of a no-deal Brexit are just as important. In fact, a recent YouGov poll showed that people think the issue of Britain leaving the EU is nearly as important as health and economy, which were the main preoccupations of us all over in the early part of the year.

So what are the takeaways for Financial Advisors? We’ve had a strong bounce back but it’s only a partial recovery. And here’s a thought: when life is so far away from being back to normal, why are the markets priced as if they’re back to normal already? In times of uncertainty, I recommend two things: stress test your investment strategies against a wide range of outcomes and take a balanced approach to asset allocation. Resilience is key – and that’s something you’ll have to work hard to build into every portfolio.

We discuss this further in our recent webinar on troubling times and of course, don’t hesitate to get in touch if we can help you here at Hymans Robertson. Meanwhile, take care and stay safe.

This blog is based upon Hymans Robertson LLP understanding of events as at date of publication. It is designed to be a general summary of topical investment issues, it does not constitute investment advice and is not specific to the circumstances of any particular financial advisory firm.

Please note the value of investments, and income from them, may fall as well as rise. This includes equities, government or corporate bonds, and property, whether held directly or in a pooled or collective investment vehicle. Further, investments in developing or emerging markets may be more volatile and less marketable than in mature markets. Exchange rates may also affect the value of an overseas investment. As a result, an investor may not get back the amount originally invested. Past performance is not necessarily a guide to future performance.

0 comments on this post