Just drifting along

06 Apr 2022

When Trustees receive reporting on hedge ratios, this is typically comparing the sensitivity of hedging assets with the sensitivity of the liability benchmark that the Liability Driven Investment (LDI) manager is using to model the liabilities. In reality, it is the actual liabilities of their scheme that Trustees want to match, so it is crucial that a liability benchmark is a good approximation for the actual liabilities.

If liability benchmarks are not updated often enough, they will no longer accurately represent actual liabilities, and hedge ratios will “drift” relative to the actual liabilities of the Scheme (although the hedge ratios reported by the LDI manager will still appear in line with target). I’ve outlined below some of the main drivers of drift.

1) Transfer Values

Over the last decade, falling gilt yields have pushed up the value of transfer values and many pension scheme members have taken the decision to take their full benefits out of the scheme in one cash lump sum. When members transfer out of pension schemes, their associated liability is extinguished. The associated interest rate and inflation sensitivity of that particular member liability is therefore also extinguished. However, unless the liability benchmark is updated, the exposure of the LDI assets is unchanged.

This failure to update the LDI asset profile to reflect the liabilities that have been transferred out of the scheme will result in a drift upwards in hedge ratios as each pound of assets in your LDI portfolio will now be hedging a lower liability amount. In practice this is a bigger issue for schemes that are experiencing a high volume of cash lump sums being taken out of the scheme and/or are well hedged. The latter being of particular interest if hedge ratios drift above 100%, which reintroduces risk!

2) Changes In Inflation Pricing

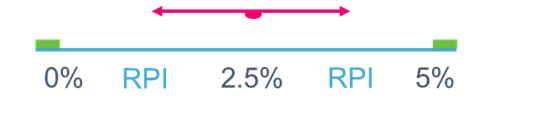

Many pension schemes have liabilities that have caps and floors. A common type is Limited Price Indexation (LPI) of 0,5, which means the liabilities are inflation-linked but with a floor of 0% and a cap of 5%. These types of liabilities are therefore fixed during some periods but inflation-linked during others.

An assumption is required to estimate the proportion of LPI liabilities that are inflation linked. This assumption is influenced by inflation pricing as well as the assumed volatility of inflation pricing. As shown by the diagram, when inflation is close to the midpoint – in this case 2.5% as the midpoint of 0% and 5% - the LPI cashflow is most “inflation-like”. When inflation is close to an endpoint, the LPI cashflow is more fixed in nature.

Over the last year, inflation has risen significantly, as economies have opened up from Covid-19 restrictions and the supply of goods has struggled to meet demand. The recent energy price hikes have further added to the inflationary pressures coming through. Inflation has therefore moved closer to the upper “cap” on LPI liabilities and for some schemes it may even have breached the cap depending on the measurement period for pension increases. Overall liabilities are therefore less inflation-sensitive. In practice, this means means is that the inflation hedge ratio drifts upwards as the inflation sensitivity of the liabilities reduces (as an increasing proportion is assumed to be fixed) but the inflation sensitivity of the assets does not (as the assets typically aren’t subject to the same caps and floors as the liabilities).

3) The right corrective action

The significant increase in inflation pricing means many schemes are now faced with deciding how to respond to higher inflation hedge ratios. The two choices are:

- Sell some inflation hedging to bring the hedge ratio back to the agreed target level i.e., sell inflation when it is “expensive”

- Reset the target hedge ratio to meet the new, higher actual inflation hedge ratio i.e., take advantage of the natural drift, lock that in, and in the process minimise trading costs.

For schemes with low hedge ratios, but ambitions to de-risk over time, option 2 may be the obvious choice. It reduces funding volatility today and prevents selling inflation hedging now, to only buy back in the future.

For schemes with higher hedge ratios, it may be more appealing to opt for option 1 and pocket the gains from recent inflation increases and at the same time reduce the risk of becoming over-hedged.

The options in responding to higher transfer value activity are similar. For schemes with lower hedge ratio targets, allowing the actual hedge ratios to drift up over time as a result of transfer values may be an acceptable form of relatively modest de-risking. For schemes with higher hedge ratios, corrective action may need to be taken to prevent hedge ratios drifting too high.

And my point is…

Keeping a watchful eye on the effectiveness of your LDI strategy has never been more important. Don’t be caught asleep at the wheel, drifting along, consider this blog as the lane assist warning! So, understand:

- The extent to which your hedge has drifted

- The drivers of that drift

- The impact on the risks that you are running relative to those you expected to be running.

And ultimately, be sure to make a conscious and informed decision on the actions taken!

If you have any questions on anything covered in this blog, please get in touch.

0 comments on this post