Provisional council results

First 100 results for Local Authority contributions

20 May 2022

It’s perhaps a sign of the uncertain times we are in today that many LGPS stakeholders are unsure of what to expect from the 2022 valuations. The headlines so far are strong past service funding positions but an increasing cost of paying for new benefits (Primary Rates). To help now complete the picture we have the provisional employer contribution results for the first 100 local authorities from funds we advise.

2022 valuation outlook

Since the 2019 valuation a lot has changed in the world yet the LGPS continues to prove its resilience. Despite the turbulent times, LGPS investment returns have been positive since 2019 and Funds are expecting to report strong past service funding positions.

However, today’s more uncertain economic outlook is putting upward pressure on the expected cost of paying for new benefits. The impact of short-term inflationary pressures and long-term expected investment returns are chiefly to blame, but on top of this we have the uncertainty around climate risk, post-pandemic life expectancy, political policy and escalating geopolitical tensions. This uncertainty flows through to not knowing what will happen to employer contribution rates at the 2022 valuations.

Removing some of the uncertainty

For long-term secure employers like councils, we are able to cut through some of the shorter-term ‘noise’ and use modelling and analysis to gain better insight and perspective. This means setting funding plans which aren’t beholden to market conditions as at end March, supporting the priority of keeping contributions sustainable and stable over time.

The additional advantage for many funds is that contribution analysis and discussions are already well underway. This allows us to share the provisional results from around 100 councils across England and Wales from the Funds advised by Hymans Robertson.

This early data represents around 30% of all English and Welsh councils and provides a solid cross-section of location, size, funding levels and current contributions in payment to look at the emerging contribution rate trends.

A balanced overall picture

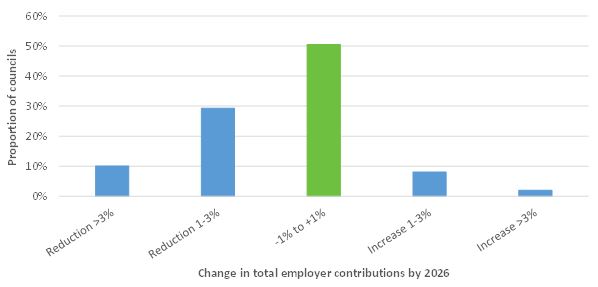

The chart below indicates what proportion of councils have provisionally agreed to increase or reduce rates, split by magnitude of the changes over the 2022 contribution rate cycle (2023 – 2026). For example, for reductions greater than 3% (far left blue bar), around 10% of councils will see a decrease of more than 3% of pay over the cycle.

Overall, it’s a reasonably balanced picture with nearly half the councils and funds agreeing to keep contributions at current levels or within a 1% of pay change over the cycle. In fact, over 85% of councils are not increasing or decreasing contributions by more than 3% of pay over the next three years.

This means the priority of stable contributions over time looks like it’s being achieved from this early provisional data. Good news for both council budgeting certainty and predictable cashflows for funds.

Looking across the spectrum of contribution levels

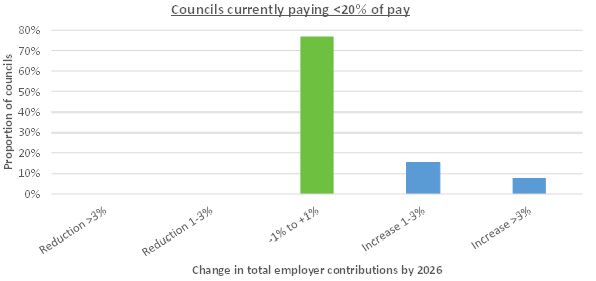

We’ve also considered the same chart but this time looking at only those councils currently paying less than 20% of pay. Our research shows that no contribution reductions have been considered for this group. This is unsurprising given that upward pressure on the Primary Rate is likely to see the average cost of benefits move into the low 20%s. However, stability is still broadly being delivered with over 90% of councils not changing contributions by more than 1% of pay per annum.

Another key observation we can make from our research is that all the councils with increases of more than 3%, over a 3 year period, belong to this group of councils currently paying relatively lower contributions.

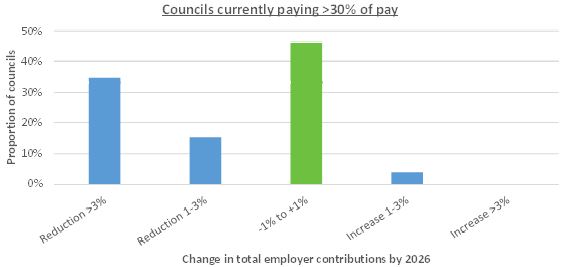

However, if we consider the other end of the spectrum - councils paying more than 30% of pay – we see a different story.

Our data shows that the majority of councils where larger reductions are being implemented are within this higher contribution group. Most funds are seeing stronger past service funding positions at the 2022 valuation, allowing higher reductions in secondary rates (and more than offsetting increases in primary rates).

Summary

With increased uncertainty, more options, growing diversity and differing stakeholder views, early engagement with councils has helped avoid surprises and time pressured conversations later in the year.

So far, the news is good - stability of contributions is being delivered for most local authorities. Those currently paying higher than average contributions will have benefitted the most from strong returns and improved funding positions and may see the “best news” in terms of rate changes over the next few years. If funding positions continue to remain strong, we would expect to see local authority rates start to converge as past service positions matter less and the ongoing cost of new benefits – which is similar for everyone – becomes the dominant factor in determining contributions.

0 comments on this post