Market performance update up to 22 May 2020

29 May 2020 - Estimated reading time: 5 minutes

Overview

Our Capital Markets Update sets out our view of economic and market developments in Q1, in particular the dramatic effect of the spread of coronavirus on financial markets since the last week of February. This blog concentrates on subsequent developments and is updated weekly. Last week’s highlights included:

- France and Germany proposed a €500bn recovery fund to support the areas of the EU hardest hit by the pandemic.

- UK headline CPI inflation fell from 1.5% in March to 0.8% in April. Lower energy prices were the main reason for the fall, but core inflation also edged lower.

- Brent Crude rose above $35 a barrel, $12 higher since the end of March.

- Equity investors reacted positively to positive news from a coronavirus vaccine trial. Global equity indices hit their highest level since early March. Credit markets also performed well.

- Gilts shrugged off April’s public sector borrowing requirement of £62bn, far and away the highest ever. Yields fell below zero at short maturities, helped by speculation about an expansion of QE.

Economic background

UK CPI inflation fell from 1.5% in March to 0.8% in April. Lower energy prices were the main reason for the fall; core inflation (excluding food and energy) did edge back down to 1.4%, the same as it ended last year and as low as it has been since last 2016. Lockdown inevitably introduced complications to the calculation through the unavailability of some services and difficulties in price collection: the Office for National Statistics calculates that CPI inflation excluding unavailable items would be 0.6%. While there has been some renewed talk about the risk of deflation, most forecasters assume that a fall in inflation this year will be followed by a modest increase in 2021. The Bank of England’s Chief economist, Andy Haldane also provided some reassurance about the Bank’s ability to combat deflationary pressure by expanding QE and even, in a reversal of previous policy, considering negative interest rates.

France and Germany proposed an EU recovery fund of €500bn to support areas hardest hit by the pandemic, which will generally be in southern Europe. This proposal was unexpected, both in terms of size – a potential fiscal stimulus equivalent to 3.6% of EU GDP – and because it represents the type of collective action that Germany, in particular, has resisted until now. The intention is that the fund will be financed by EU borrowing and repaid out of future EU budgets.

Market update

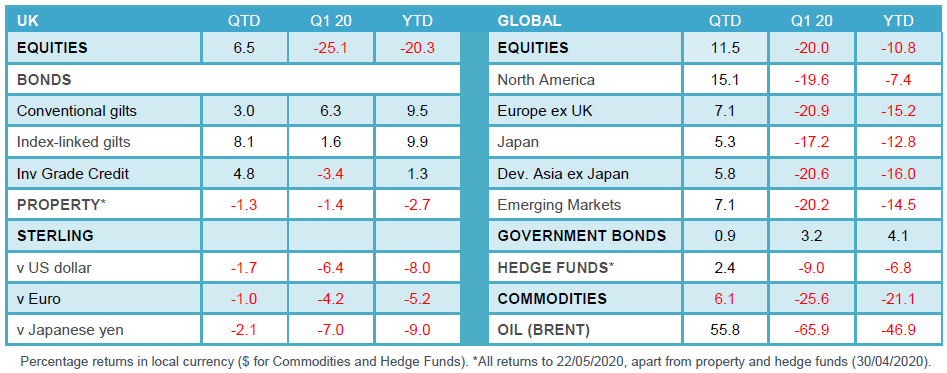

The table below highlights some of the market movements since the beginning of the year:

Equity markets

Global equity indices rose almost 3% last week, although smaller Asian and emerging markets were a little lower. Markets were boosted particularly by encouraging news in the middle of the week from a small coronavirus vaccine trial, but slipped back later after a more measured reassessment of the significance of the news. Global indices are now almost 12% up from the end of March and just over 10% down so far this year. For the quarter and year to date, only the US of the major regions has outperformed global averages.

Oil & gas was the best-performing sector last week; basic materials and technology also performed well. These three sectors are at the head of the rankings for the current quarter, with traditionally defensive sectors at the bottom. Since the end of December, technology leads the pack, followed at some distance by consumer sectors; financials and oil & gas are the biggest laggards.

Bond markets

Helped by Andy Haldane’s comments and speculation that further Quantitative Easing might be announced in June 2020, 10-year gilt yields fell last week and are now 0.2% p.a. lower this quarter. At shorter maturities, gilt yields dipped below zero; the Treasury issued bonds at a negative yield for the first time ever. Notwithstanding the fall in current inflation, the recent relative performance of conventional and index-linked gilts suggests little concern about deflation: 10-year gilt implied inflation is 0.2% p.a. lower so far this year, rising marginally last week and little changed since the end of March.

The EU’s proposed recovery fund was seen as positive for peripheral eurozone government bond markets. 10-year yield spreads over German bunds fell by 0.3% p.a. in Italy and 0.2% p.a. in Spain to their lowest levels for two months. In both cases, spreads are still roughly 0.5% p.a. higher since the end of 2019.

Mirroring improved sentiment in equity markets, credit markets performed strongly last week. Spreads on global corporate investment-grade indices fell by 0.2% p.a.; equivalent speculative-grade (BB+ and lower) spreads fell by 0.6% p.a.. US dollar denominated emerging market debt has followed the pattern of corporate credit markets. Spreads on the EM debt index fell 0.4% p.a. last week, have narrowed 0.8% p.a. this quarter and risen 2.5% p.a. this year. Local currency emerging market debt markets also performed well.

Other markets

Brent crude, the international index for oil, has climbed back over $35, $12 above its end-March level but only a little more than half of its end-2019 level. The latest leg of the price recovery has been supported by both the perception that demand is no longer deteriorating as lockdowns ease gradually and evidence that the implementation of supply cuts agreed between oil producing nations last month may have been more effective in the short term than many commentators had expected.

Sterling has tended to follow the fortunes of riskier assets throughout the crisis. True to form, it recovered a little last week against the US dollar and Japanese yen, but it couldn’t quite match the strength of the euro, which was boosted by a positive reception to the proposed recovery fund. Sterling was more or less unchanged in trade-weighted terms, leaving it 1.4% lower this quarter and 5.2% below its end-2019 level.

Our View

Recent positive market moves have slightly reduced the apparent cheapness of global equity and credit markets but the outlook for corporate earnings and defaults remains very uncertain at this stage, with sentiment likely to remain fragile through the first half of 2020. Lockdowns are beginning to be relaxed as some economies pass the peak of infections, but the sudden stop to global activity is now expected to generate the most severe recession in living memory and the restart is unlikely to occur quickly. Furthermore, unprecedented fiscal and monetary policies may provide short-term liquidity and ease market stresses, but they may be unable to halt rising unemployment or prevent insolvencies in the deep downturn entered.

We continue to advocate holding more cash than usual, with a view to reinvesting with greater certainty at some point in the future. Just as importantly, in a period when market activity could be depressed for some time, there is a need for caution in meeting liquidity requirements associated with outgo as well as the collateral management associated with settlement of interest rate and currency hedging strategies and other derivative positions.

0 comments on this post