Market performance update up to 24 April

29 Apr 2020 - Estimated reading time: 4 minutes

Our Capital Markets Update sets out our view of economic and market developments in Q1, in particular the dramatic effect of the spread of coronavirus on financial markets since the last week of February. Here we concentrate on subsequent developments.

Overview

Recent global economic data continue, on balance, to fall short of expectations, but investors appear to have focused on accumulating evidence that infection rates in Europe and the US have peaked. Although some European countries have made tentative first steps to easing lockdown restrictions, anecdotal evidence suggests that forecasters are becoming less optimistic about the speed and scale of any post-pandemic recovery.

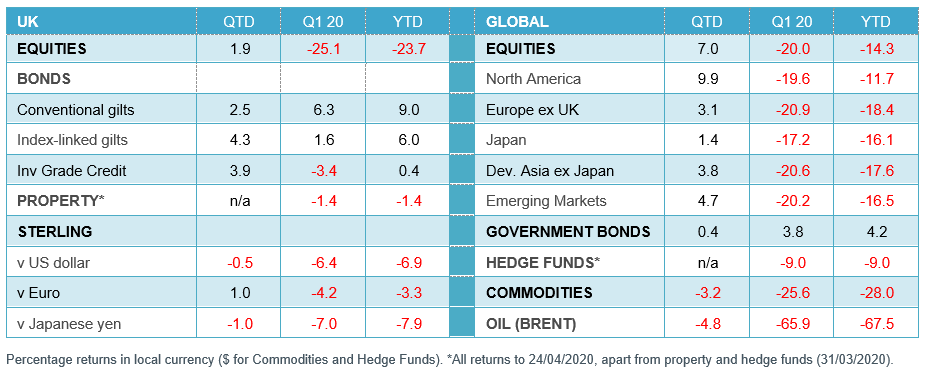

Equity and credit markets have risen over the month; global equity indices are now around 22% off the lows of late-March, but still 14% lower over the year. Yields in the major government bond markets drifted a little lower last week and are now little changed from end-March levels.

Oil prices collapsed further: Brent crude fell below $20 a barrel for the first time in 18 years. The current excess of supply over demand was highlighted in headline-grabbing manner when storage constraints led to the US benchmark price falling below zero at the start of the week.

Economic background

The Office for Budget Responsibility have suggested, in what they called an illustrative scenario rather than a forecast, that UK GDP could fall by 35% in the second quarter if the current lockdown lasts for three months. Like most commentators they assumed that the rebound would be rapid.

Global forecasts for the full year are less jaw-dropping. The latest survey from Consensus Economics suggests global GDP will fall 2.1% this year, with recessions in the major advanced economies greater than those experienced during the Global Financial Crisis but bounce back by 4.4% in 2021. The uncertainty surrounding these numbers is even greater than usual. Not only are the Consensus Economics numbers now a few weeks out of date, but the FT has noted that the dispersion of forecasts is far greater than is typical.

Another plunge in oil prices last week has taken them back below the lows of 31 March. Brent crude, the international benchmark, fell below $20 a barrel for the first time in 18 years, before rallying slightly to $21.5 at the end of the week. But the headlines focused on the US benchmark, West Texas Intermediate crude, where prices of the May futures contract fell to a low of negative $38 a barrel as it reached expiry early in the week. Settlement of outstanding WTI futures at expiry is by physical delivery of oil to Cushing, Oklahoma. A lack of available storage meant that those who were able to receive oil were being paid to take it off the hands of other traders with long positions. Trading has now moved to the June contract, which fell 25% this Monday, stoking fears that it could follow the May contract to $0 and below.

Foreign exchange markets were again quiet last week. Sterling slipped a little in trade-weighted terms but has still risen 0.3% so far in April.

Market update

The table below highlights some of the market movements since the beginning of the year:

Click here to view a larger size image of this table.

Equity markets

Deteriorating news on global corporate earnings had little impact on equity markets last week. Global equity indices fell a little but are now around 22% above the market low reached on 23 March and 14% lower over the year. Volatility is still high, albeit well below the peak levels of March.

Looking across sectors, this year’s performance rankings continue to be led by technology and consumer stocks. The worst, by some margin, remains energy. However, perhaps surprisingly, energy was the best performing sector over the week. Financials again struggled and are the poorest performers so far this quarter.

A better showing from energy stocks helps to explain a better relative performance from the UK last week, although regional performance divergence was not significant. UK performance is well behind performance averages both for this quarter and in 2020: the US, supported by its large technology sector, remains the leader over both periods.

Bond markets

Global government bond yields drifted a little lower last week. 10-year yields in the major markets are now marginally lower than they were at the end of March, but have not tested the lows reached in early March. Investment-grade credit spreads were also little changed but, consistent with a weaker tone in equity markets, speculative-grade spreads rose.

However, spreads have fallen substantially over April. This primarily reflects the expansion of the corporate credit purchase programmes of the US Federal Reserve (Fed). The potential size of these programmes is now $750bn, roughly 15% of the entire US investment-grade non-financial universe.

UK property

The MSCI UK Monthly Property Index for March showed a fall in capital values of 2.4% for the month and 2.7% for the first quarter. With little or no transaction activity in the direct market and most property funds having suspended dealings, it is likely that this understates the underlying downturn. Anecdotal evidence suggests that April’s quarterly rent collection for institutional property funds is, on average, just over half of what it would normally have been.

Our View

Recent positive market moves have slightly reduced the apparent cheapness of global equity and credit markets. But the outlook for corporate earnings and defaults remains very uncertain at this stage, with sentiment likely to remain fragile through the first half of 2020. Even if lockdowns begin to be relaxed, the sudden stop to global activity is now expected to generate the most severe recession in living memory, and the restart is unlikely to occur quickly. Furthermore, unprecedented fiscal and monetary policies may provide short-term liquidity and ease market stresses, but they may be unable to halt rising unemployment or prevent insolvencies.

We advocate holding more cash than usual, with a view to reinvesting with greater certainty at some point in future. Just as importantly, in a period when market activity could be depressed for some time, there is a need for caution in meeting liquidity requirements associated with outgo as well as the collateral management associated with settlement of interest rate and currency hedging strategies and other derivative positions.

0 comments on this post