Insurance professionals reveal their biggest concerns for IFRS 17

15 Aug 2017 - Estimated reading time: 2 minutes

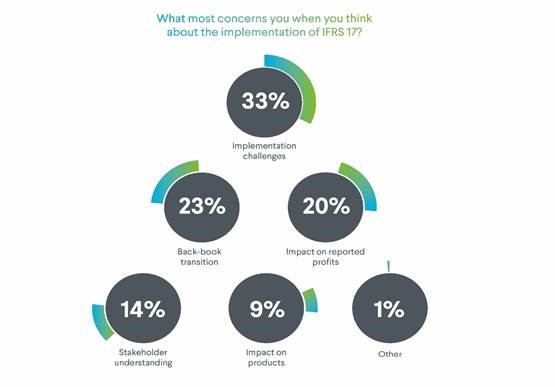

A poll of over 100 industry professionals has identified a wide range of concerns regarding the new accounting standard for insurance contracts – IFRS 17 – which is due for implementation in 2021. The poll was conducted by Hymans Robertson during a webinar where industry experts gathered to discuss the challenges and opportunities IFRS 17 will present for the insurance industry.

Stephen Makin, Head of Risk and Capital Management responds to the findings:

“The distribution of responses shows that concerns within the insurance industry are wide-ranging when it comes to implementing the new accounting standard. Adopting IFRS 17 will affect almost every aspect of the business and will require a much greater involvement of actuaries in profit reporting than the industry has been used to.

"It is no surprise that implementation challenges – covering system changes, new data requirements, resource needs and the inevitable cost implications – were of chief concern in our poll. The scale of the task at hand should not be underestimated, especially when combined with the complexities of managing the one-off transition by 2021.”

Notes:

The poll was conducted by Hymans Robertson during a webinar where attendees gathered to discuss the challenges and opportunities IFRS 17 will present to those in the insurance industry. Responses based on polling of 117 webinar attendees.

Hymans Robertson have published a whitepaper today further explaining the new reporting standard and how firms should approach this.

0 comments on this post