rather than acting as another delay tactic

Social Care Green Paper must provide forward-looking policies

08 Mar 2017

- If we don’t solve the long-term care and savings crisis with cohesive social, savings and health policies we can’t, as Hammond promised, “ensure our children will enjoy the same opportunities we do”

- Without clarity individuals won’t save enough and the insurance market will have difficulty designing appropriate products

- UK desperately needs clarity on where the money will come from to pay for social care

- The system of means testing and benefits is so complicated that it’s difficult for us to work through as financial professionals, never mind those needing care

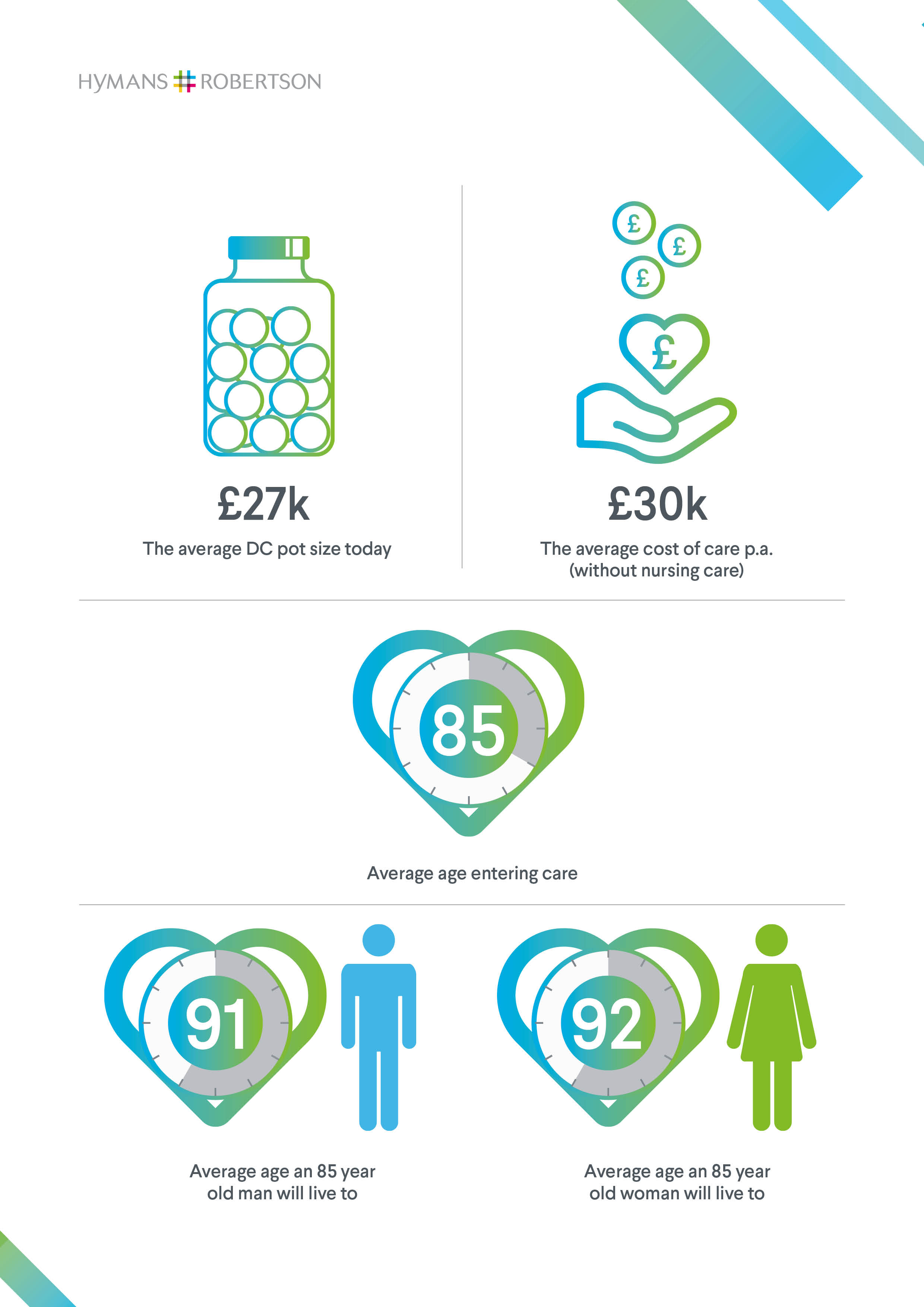

- Allowing individuals to make tax free withdrawals from pension pots to pay for care have been mooted – but the average pot size today is £27k, and the average cost of residential care even without nursing is £30k per annum. At current savings levels there is little hope of pensions filling the gap in paying for social care.

Discussing the drivers behind the review of social care, Karen Brolly, Life & Financial Services Head of Products, said:

“The government has said it will set out proposals in a Green Paper to put the social care system on a more sustainable long-term footing given future demographic changes. The combination of an ageing population and austerity biting means the government is under intense pressure to solve the current crisis in social care. It urgently needs to tackle the issue of ever-increasing costs from an ageing population.

“We desperately need cohesive policy-making that will address the problems caused by successive Governments kicking these issues into the long-grass. The solution is integrated social, savings and healthcare policies that recognise the effects of demographic change. Will this come out of the next Green Paper? We’re sitting on a time bomb. To protect future generations, it’s a must.”

Commenting on potential policy options that may appear in the Green Paper, she added:

“One idea that’s been mooted is enabling people to withdraw money from pension pots tax free to pay for care. While this is a good idea in principle, unfortunately most pension pots fall short of being adequate to live off, never mind paying for care needs. Today the average DC pot size is £27k*. To put this in context it costs £30k per annum for care without nursing rising to £40k per annum with nursing.

“While auto enrolment and the shift from DB to DC will see DC pot sizes rise in time, the fact remains that three quarters of UK workers are not saving enough. At current savings levels there is little hope of pensions filling the gap in paying for social care. As a nation we don’t have a savings culture. Gross UK saving has halved in the past 40 years. At the same time debt has tripled and consumption keeps rising. Without significant policy changes, we can’t rely on individuals to foot the bill.”

“Another option the Green Paper may look at is a ‘Care ISA’. We have to ask if people will be incentivised to save more to pay for care? They are repeatedly told they won’t have enough to live off but still don’t save more, often because they can’t. Will individuals engage with the fact that they might need care, and will they see it as their responsibility or indeed a necessity to cover those costs themselves when the Government provides a backstop for those who can’t afford it?”

Explaining the need for the Government to be clear on what it will provide in term of long-term care and for greater education among individuals, she said:

“We need the Government to be clear on what the State will cover in respect of long-term care. There needs to be greater awareness of the costs of long-term care, and how long those costs might need to be paid for, but crucially who will pay what. Until we have that people just won’t put more aside as they’ll assume the State will foot at least a large part of the bill. Given means testing, the Government is always the backstop if you don’t have any money. People may ask if that’s the case, why save? Perhaps for a nicer care home or to protect your estate for inheritance purposes, but it’s a tough sell and only applies to those with personal wealth.

“Almost 6 years ago the Dilnot Commission undertook a review of social care. The main recommendations were to set a cap on individual social care costs and to bring in a means-tested asset threshold. Dilnot looked at the balance between the individual’s and the State’s burden. Unfortunately the system of means testing and benefits is so complicated that it’s difficult for an actuary to work through, never mind those needing care! And the cap, which was due to be implemented last year, has been delayed until 2020.

“Dilnot also expected that a market for insurance would emerge to cover the cost of care up to the point at which the Government took on the bulk of the costs. That hasn’t been the case.

Discussing how this lack of clarity is preventing the development of appropriate insurance products relating to care, she added:

“It’s not just individuals but also insurers that need clarity. Understandably they are reluctant to develop products when there is no certainty over the structure of funding for long term care. Once we have a clear and stable structure, then products can be designed to meet individuals’ needs. Product innovation is difficult in an unstable policy environment. And how to fund the State’s contribution to adult social care has never been settled.

Emphasising the need for coherent policy making, she said:

“While a review into social care is welcome, there needs to be political will and commitment to implement recommendations. We need integrated social, savings and healthcare policies that recognise the effects of demographic change. That means it needs to be considered in the round with other policies, particularly the review of State Pension Age due to report soon and other policies around long-term savings.

“The Government must wake up to the economic and social value of investing in care. Most of the solutions trailed rely on the individual. This works on the basis that individuals are in a position to save more themselves. There needs to be a collective response to the issue.”

*From our Guided Outcomes database

0 comments on this post