Apps and APIs

Our suite of outcomes-based modelling APIs can be integrated into your web and mobile applications, helping you engage meaningfully with your customers.

We help financial services companies deliver better customer outcomes through digital engagement.

Contact the team

People in the UK face difficult choices when it comes to balancing their day-to-day spending with saving for a rainy day, or retirement. For many, financial services products are hard to understand, which makes decision-making daunting.

We believe that every pound is important. It’s our job to help people make the best decisions to make the most of their savings, regardless of how much they have and whether or not they have access to financial advice.

Financial services businesses aim to create products that meet the needs of their customers at competitive prices. Our role is to help improve understanding, engagement and positive decision-making, driving better customer outcomes.

We do this using our extensive experience in modelling, data, digital and investment across retail and workplace markets in both advised and non-advised sectors. For over a century, we’ve been helping pension schemes, employers and financial services providers look after their members, employees and customers through our institutional-grade models, innovation and insight.

Our clients use this to power their customer propositions by:

We help our clients solve challenges. Our solutions are designed to put good customer outcomes first, allowing you to attract, grow and retain assets while delivering a better customer experience.

We can provide:

economic scenario service, using our stochastic forecasting engine

goals-based saving APIs

decumulation planning APIs

longevity data APIs

pre-built digital products and APPs

accumulation strategic asset allocations

decumulation strategic asset allocations

UX design and application build.

Hymans Robertson’s unrivalled digital capability allows you to enrich your proposition quickly and seamlessly, enabling us to look after the day-to-day maintenance.

Our suite of outcomes-based modelling APIs can be integrated into your web and mobile applications, helping you engage meaningfully with your customers.

The Economic Scenario Service ("ESS") is a suite of mathematical models that allows you to explore the consequences of today’s business decisions on tomorrow’s outcomes.

Our strategic asset allocations (SAA) provide optimal frameworks for fund managers to develop solutions for specific customer-risk profiles.

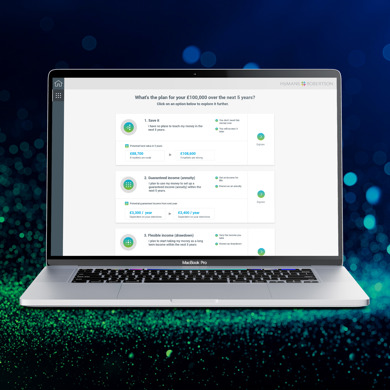

Learn more about how our GO for investment pathways app can enable your customers to make more informed retirement decisions.

Hymans partnering approach and combination of technology solutions, consulting services and distribution reach has enabled us to deliver a market leading proposition to our customers. It is a pleasure working with them.

Contact our team today to learn how we can help your business make better risk and people decisions.

Get in touch

With experts across pensions, benefits, insurance, and digital, find the right person to support you.

Search experts