Overview

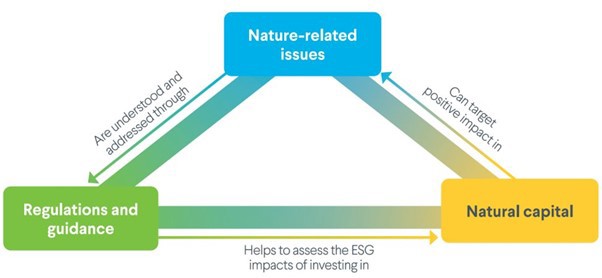

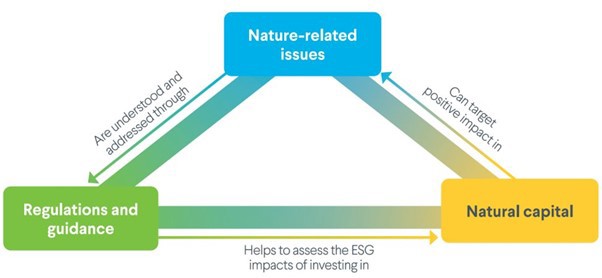

Nature has become a critical issue for investors, however it can be overwhelming to understand the different ways in which nature related issues relate to your investments, and the actions required to get the best outcomes.

In our recent webinar, we were encouraged to see around 2/3rds of attendees are either already considering nature and/or biodiversity in their investment strategy, or planning to do so over the next 1-2 years. Throughout the webinar we explored how nature can impact your investment portfolio through three different perspectives:

-

What are the key nature-related issues to be aware of?

-

What regulations and guidance surround nature-related investing?

-

What is “natural capital” and why/how should you invest in it?

Nature-related issues

Climate change and biodiversity loss are two of the most pivotal nature-related issues.

Climate Change: To meet the 2015 Paris Agreement goals, global temperature increases should be limited to 1.5°C above pre-industrial levels, or at most 2°C. Achieving this requires a drastic reduction in global greenhouse gas (GHG) emissions and a shift away from fossil fuels. Failure to do so exposes companies and investors to physical risks (like rising sea levels) and transition risks (such as assets losing value due to stricter regulations).

Biodiversity: Biodiversity encompasses the variety of life on Earth, including different species, ecosystems, and genetic diversity. The biodiversity crisis is driven by habitat loss, overexploitation, pollution, climate change, and invasive species. Biodiversity loss and climate change are closely linked, with each exacerbating the other. For example, deforestation drives both biodiversity loss (e.g. loss of key habitat) and climate change (both through removing trees which previously captured carbon emissions and from direct emissions due to the deforestation process).

So why do these issues matter to investors? There are three key reasons:

Regulations and guidance

There are emerging regulatory frameworks covering key sustainability topics, including nature-related issues:

-

TCFD (Task Force on Climate-related Financial Disclosures): A regulatory requirement for large DB pension schemes since 2021 to report on climate-related risks and opportunities.

-

TNFD (Taskforce on Nature-related Financial Disclosures): Published in September 2023, this framework focuses on nature-related risks and is expected to influence future regulatory requirements. This is likely to become mandatory alongside TCFD requirements.

-

TISFD (Taskforce on Inequality and Social-related Financial Disclosures): Still in progress, this framework will address social factors and inequality, and is likely to play a role in integrated sustainability disclosures.

Although there is lots of guidance and support in assessing risks and opportunities, over time we expect to see some consolidation of these frameworks and requirements. In terms of action, investors should take the opportunity to build on any progress to date through their work on TCFD, to incorporate elements of these other frameworks where possible.

Investing in “natural capital”

Natural capital refers to the world's natural assets, including renewable and non-renewable resources and ecosystems. These assets provide essential services, such as food, building materials, environmental regulation, and recreational benefits.

Natural capital investments offer strong, diversified returns and inflation protection. These returns stem from:

-

Direct Use of Assets: For example through leasing land or selling products produced on it such as waste or food. Key examples include investments in timberland and sustainable agriculture.

-

Monetising Ecosystem Services: Trading carbon or biodiversity credits. A key example of this is in timberland, where managers may seek additional returns by managing assets in a way that absorbs a higher than usual level of carbon from the atmosphere and be paid in the form of carbon credits for doing so.

-

Technologies supporting natural capital: Investing in companies and businesses that are supporting efforts towards protection and regeneration. For example carbon capture technology or companies focussed on sustainable packaging.

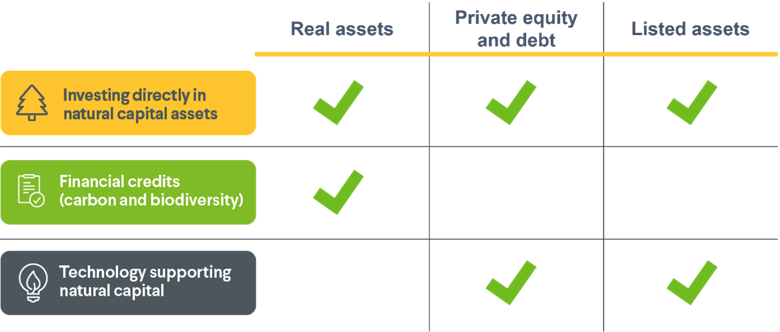

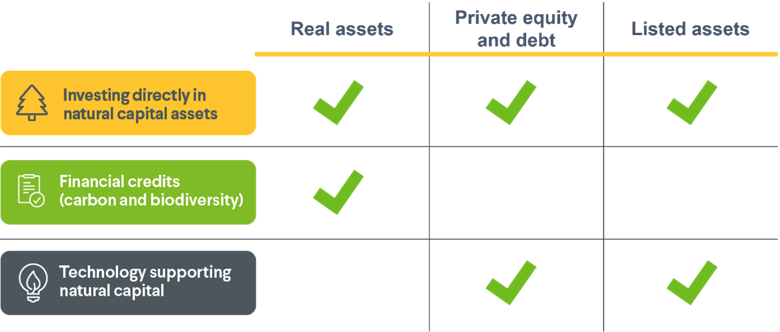

Taking these 3 return mechanisms, each can be accessed through investment across one or more asset classes - across real assets, private equity / debt and liquid equity / credit:

Summary and actions for investors

Nature-related issues such as climate change and biodiversity loss are key considerations for investors and have significant financial implications.

Investors will all have different goals, and so how nature related issues should be considered and incorporated into a portfolio will vary. There are 4 key areas of potential action to get started:

-

Education: Attend training to understand the impact of nature-related issues on your portfolios and the regulations surrounding natural capital. 59% of those on our webinar said this will be the first action they’ll take.

-

Engagement with Managers: Understand how your investment managers are thinking about nature-related issues, the opportunities they see, and their reporting practices.

-

Monitoring: Track climate metrics and select key nature-related metrics to understand portfolio exposure to key sectors and sensitive locations.

-

Strategy Development: Explore opportunities to integrate natural capital within your overall investment strategy.

NOT ADVICE. The information made available in this webinar is for general information purposes only. It is not to be relied on for taking (or not taking) any action or decision. It is not a substitute for professional advice (including for legal, investment or tax advice) on specific circumstances. Your Hymans Robertson LLP consultant will be pleased to discuss any issue in greater detail.