Buying out all scheme liabilities and winding up the scheme is often the hardest job a board of trustees will ever be faced with.

Our experience and recently carried out surveys suggest that while increasing numbers of schemes are heading towards buy-out and wind up as their ultimate goal, many of the trustees surveyed feel that some, or all of the tasks to prepare for wind up will be challenging. We hear a number of myths and rumours flying around, from trustees, pension managers, companies and even consultants who specialise in other areas! In this series, we aim to bust those myths and promote a better understanding of the journey to wind up a scheme.

Myth 1: “Wind up is straightforward!”

It is well and truly a myth that you can wind up a pension scheme by simply ticking a few boxes on a form; they are complex, multi-stakeholder, often multi-year projects with many potential pitfalls to navigate. For many trustees, wind up will be a leap into unfamiliar territory. Throughout the process, many stakeholders must be brought together, including members, the company, administrators, actuaries, lawyers, the insurer... all at the same time as making sure members are comfortably in the know and meeting the various statutory requirements.

Sound straightforward? It can be, but it’s important to be aware of what can go wrong and how you can overcome these challenges.

Buy-in is just the first step - don’t underestimate the tasks involved!

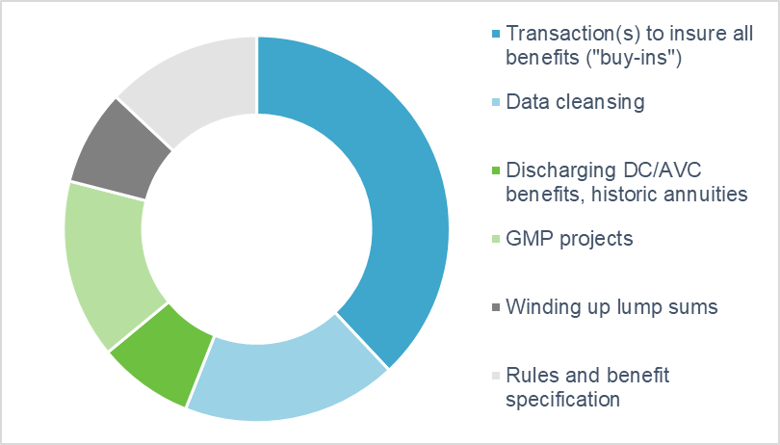

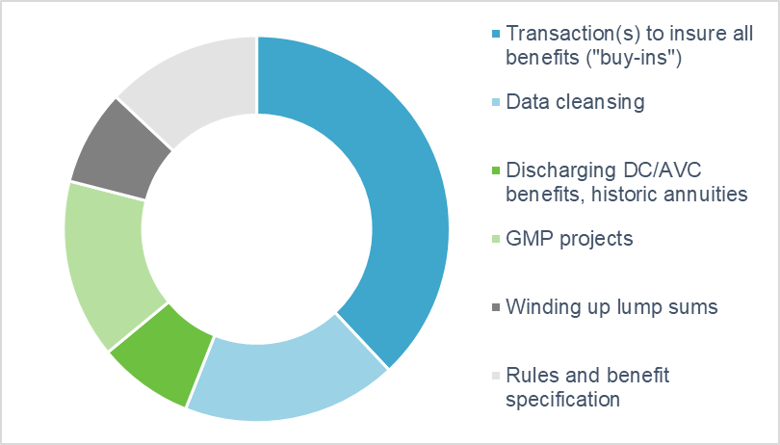

Insuring all your benefits with an insurance company is just the first step towards reaching buy-out and ultimate wind up. There can still be a number of sizable projects, important considerations and challenging decisions to be undertaken before a scheme can be wound up – the chart below illustrates the key hurdles and gives an idea of the level of time, effort and cost trustees typically need to dedicate to each.

Concerned about the large light blue data cleansing chunk? Stay tuned, the next instalment in our series will bust several myths around data and cleansing requirements…

Communicating well with members is key!

It’s vital that all member correspondence is well timed, and well explained, to avoid concern members may have about their benefits and options, as well as scams. If a member complains about anything during the process, be it their benefits, an option being offered to them, or the correspondence (or lack thereof!) they’ve received, it can add both time and costs to the project.

Even if you’re on the right track, you’ll get run over if you just sit there – Will Rogers

Without strong and expert direction, projects can lack impetus and drag on for a very long time - the longest project we’ve heard of took 25 years! The longer a project goes on, the longer the scheme must pay fees and ongoing costs, and while there is no need to rush these projects (indeed, other problems can stem from trying to take short cuts!), there is merit in planning a realistic timeframe – and driving the actions through to completion to make these plans a reality. Having someone responsible for planning, overseeing and directing the various tasks, and drawing in relevant parties when needed is key – all the while helping to steer away from potential pitfalls from beginning to end.

In conclusion…

It’s important to be aware of what’s involved in the wind up process, to make sure that you’re prepared to overcome any challenges that come your way and to ensure the wind up is given the time and attention it needs. This ultimately ensures a good outcome for the scheme and its members.

If you want to find out more, please get in touch.