One of the hottest topics this summer has been Taylor Swift’s Eras Tour. Trending almost as strongly (perhaps with a less global audience!) is the LGPS conversation about our new funding era.

The previous funding era was defined by funding black holes, high and climbing employer contributions, high investments in growth assets, death spirals and crippling employer cessation debts – we were all familiar with the issues and the jargon (and of course the solutions).

The 2022 valuations marked the start of a new era for the LGPS, as the scheme on average in England and Wales moved into surplus, revealing an average funding level increase to 107%, and a fall in the average employer contribution rate from 21.9% to 20.8% of pay. However, this transition happened in a period of considerable uncertainty, with the aftermath of the pandemic leading to both a strained economic outlook and fluctuating mortality rates.

Funding dynamics since 2022

Funding levels are a useful summary statistic, but the calculation is complex and depends on multiple factors. Two key drivers are how many assets you have and the return you expect to earn on those assets through investing them. A 100% funding level might suggest that the fund holds all the monies they need to meet their members’ pension obligations. However, 100% funding level means that the assets held, together with the future returns expected, will be enough to pay the benefits. Usually, the expected returns make up about 40% of the necessary funds. So even in 100% funding – there’s a lot of work to do.

Funding level vs. assumed future return

Source: Hymans Robertson Analysis

This chart shows the relationship between funding level and assumed future asset return for the LGPS in England and Wales (as an average). Normally if you plot this chart at two different dates, you would have two different lines indicating more or less assets. But actually, we’ve had modest asset returns since 2022 valuations. There’s variation between funds but most are close to their central estimate or projection of asset returns so the lines are similar.

Since 2022, what has shifted is the consideration of what returns might be available on different asset classes. In 2022, a 107% funding level was based on a 4.4% pa expected return on assets, significantly above the 1.7% pa yield available on UK government bonds. In 2024, gilt yields have risen to 4.7% pa, surpassing the 2022 discount rate.

A higher potential future return means you need less money today to fund the same amount of pension. We’ve seen the impact improve both insurer annuity rates (how much capital you need to buy pension from an insurer) and private sector scheme funding levels. The LGPS will need to consider the extent to which this change in environment will further improve LGPS funding levels.

Mortality trends post-Covid-19

When funding pension schemes, we need to make a prediction of future mortality rates. After the excess mortality experienced through 2020 - 2022 there is an argument to say that 2023 mortality wasn’t far off pre-COVID trends (see chart below).

This is perhaps the first positive sign that we might be able to get back on track of the trend of modest mortality improvements that were seen during the 2010s. However, it is unlikely to meaningfully change the mortality assumptions most LGPS funds made in 2022, with no significant negative impact on funding.

Standardised Mortality Rates: Unisex, England & Wales, 2011-23

Source: CMI mortality monitor week 52 of 2023

Strategic opportunities in a surplus environment

With the LGPS moving into surplus, new strategic opportunities arise. Here are some considerations for funds and their stakeholders:

-

For Funds: Funds are rightly cautious about significant changes in contribution rates, focusing on long-term stability. For example, across Scotland at their 2023 valuations there was a surplus increase of c£14bn and about a third was allocated to reducing employer contributions over the next 20 years, meaning 2/3rds was kept by funds. The retained surplus may be used to rebuild prudence margins and address known risks such as climate change.

-

For Employers: A stronger funding position opens doors for employers to consider exits. But more affordable contribution rates may influence employers to consider the excellent recruitment and retention benefit and LGPS pension offers their employees.

-

For Taxpayers: The LGPS stands out as a success story, especially compared to the increasing employer costs of other unfunded public service schemes. The LGPS should not be shy in communicating the benefits of having invested assets and their positive community and global impacts.

Private sector dynamics

The LGPS is often shaped by trends, not only in local government service delivery, but by the wider pension market. In the private sector, defined benefit (DB) schemes are now rare, with most transitioning to defined contribution schemes with much lower levels of pension saving. This trend highlights a stark contrast: while public sector pensions like the LGPS remain robust, many private sector savers may not achieve an adequate pension.

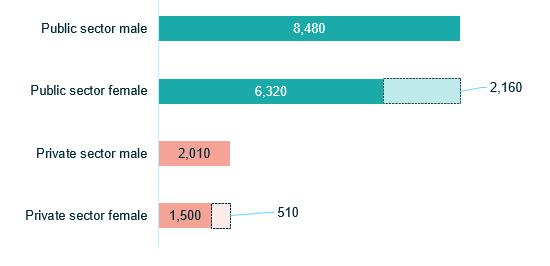

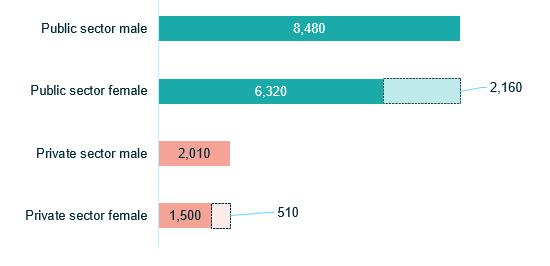

Median average saved (£ pa)

Sources: The Pension Regulator’s 2023 DB Landscape analysis and The Gender Pensions Gap in Private Pensions - GOV.UK (www.gov.uk)

Private sector DB schemes have also seen significant funding improvements. In the three-year period to 31 March 2023, the average funding level was higher compared to three years earlier (by around 25%). As these schemes also move into funding surpluses, policy makers and scheme sponsors are reviewing whether buy-out is still the ultimate goal, or whether there are advantages in schemes running on.

There's been a shift in policy maker thinking, with focus on how DB assets (sitting at around £1.5 trillion) could be invested in ‘productive finance’ and used to stimulate the UK economy. The ‘Mansion House’ proposals are energising debate on running schemes on with more flexibility for surpluses. Run-off could become more attractive to some if proposed reforms come through.

How may the private sector changes impact the LGPS?

-

We believe the LGPS provides an adequate pension for its members, but the increasing gap between private and public sector pension provision may be a source of societal strain. The private sector should be encouraged to “level up”, not the LGPS to level down.

-

The new government is also likely to be interested in how pension scheme assets can support productive finance and the LGPS will be included in their proposals.

-

Given the positive state of funding health in the private sector, and a reducing number of schemes, might the Pensions Regulator have extra capacity to direct towards the LGPS.

For those navigating this landscape, the journey might not come with a concert ticket, but it offers its own form of opportunities and excitement for the LGPS.

If you have any questions, or would like to discuss anything further, please get in touch.

This blog is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.