The Bulk Purchase Annuity (BPA) market has experienced remarkable expansion over the past few years, reaching a historic milestone with nearly £50 billion in volumes recorded in 2023. This surge in activity can be attributed to several key stakeholders, including reinsurers who play a pivotal role in shaping the market’s trajectory.

The reinsurance sector’s capacity and innovative solutions have enabled insurers to manage risk effectively, facilitating the transfer of pension liabilities to annuity providers. Without the support and expertise of reinsurers, this level of market growth would have been unattainable.

In this article we discuss why reinsurance is an important tool for insurers, recent reinsurance usage trends observed in the BPA market, and what the future looks like.

Common uses of reinsurance

The different risk exposures and risk appetites of insurance companies mean that reinsurance is used in a number of ways. As there isn’t a ‘one size fits all’ offering, we begin with some common examples of how reinsurance is used in the BPA market and why it is important to insurers in this current environment.

Flow reinsurance – small scheme treaties

Flow reinsurance uses pre-arranged treaties which enable the insurer to transfer longevity risk on a quota share of new business quickly and efficiently and provides insurers with price certainty. With the increased focus at the smaller end of the market, more and more insurers are making use of flow treaties. Whether that’s putting new arrangements in place or by renegotiating terms of their existing treaties to increase individual deal limits and/or total volumes that the insurer can write. Many insurers have made it clear that they do want to support the smaller pension schemes in the market. They are doing this by streamlining their pricing process allowing them to reallocate/optimise resources to unleash the value that comes with small schemes. Flow reinsurance treaties fit well to support this goal.

Facultative longevity reinsurance

As we all know, 2023 was the year of the larger transactions, with c.60% of transaction volumes coming from deals over £1bn. Facultative longevity reinsurance is what has commonly been used for these transactions. This type of reinsurance is tailored to meet the characteristics of a particular transaction, with terms negotiated for each transaction. The pricing in the market is increasingly competitive reflecting the appetite on both demand and supply side for this type of reinsurance. However, it’s worth remembering that bespoke pricing and terms usually take longer to negotiate and are therefore more resource intensive. As such, this continues to bring competing challenges for reinsurers around which transactions to provide pricing for and how best to maximise their resources.

Funded reinsurance

Unlike the previous examples, funded reinsurance covers asset risk as well as longevity risk transfer. Funded reinsurance has increased in popularity over the years with insurers now using it as a tool for scaling up capital, optimising capital, and taking advantage of opportunistic pricing. Funded reinsurers are commonly based outside of the Solvency UK jurisdiction (e.g. in Bermuda and the US), allowing them more investment freedom than that of UK insurers.

Funded reinsurance does come with more inherent risk than longevity reinsurance. This is because the full asset risk is passed across to the reinsurer at the outset. If the reinsurer does fail, there could be a sizeable loss for the insurer. This is where recapture plans become increasingly important to ensure this risk is managed.

These examples cover the common types of reinsurance used in the BPA market at the moment and they give an idea of how reinsurance can meet a variety of needs. Each insurer will be responsible for assessing both the benefits and risks of each type before putting these types of arrangements in place.

Recent trends in longevity reinsurance

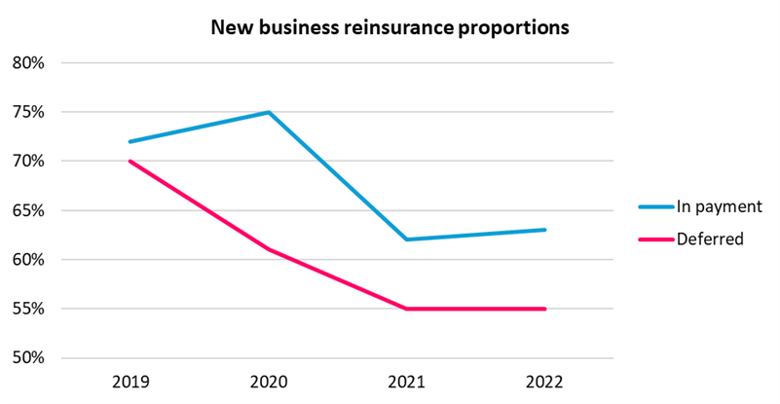

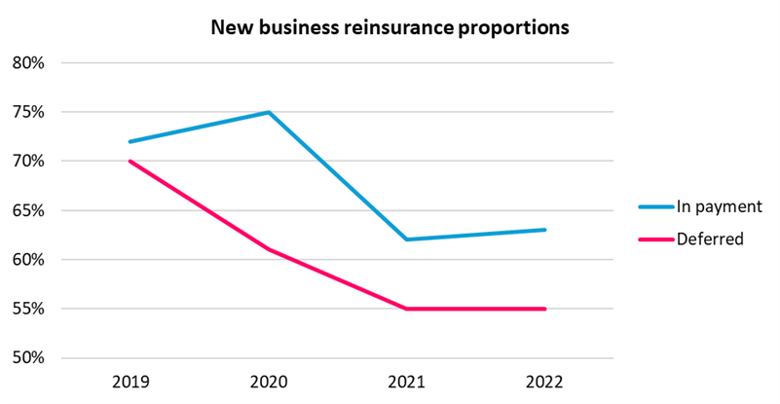

Volumes of reinsurance usage continue to change in response to developments in the market. The chart below illustrates how new business reinsurance proportions have changed for BPA insurers since 2019. The information comes from our annual Matching Adjustment survey and reflects longevity reinsurance only (excludes funded reinsurance). We note that, although the participants and number of respondents to the survey have changed over the years, and some participants may seek reinsurance after a transaction (skewing the results), it provides a useful ‘at a glance’ picture.

We can see that, for both in-payment and deferred blocks of business, there has generally been a downward trend in the proportion of new business reinsured. Given that demand for longevity and asset reinsurance continues to be met, this reduction is purely the proportion of new business reinsured and not necessarily the volumes reinsured. One contributor to this reduction might be the increased use of funded reinsurance, which also captures longevity risk but is not reflected in the chart below. From speaking to some insurers and reinsurers in the market, we estimate that around 20% to 30% of volumes written in 2023 used funded reinsurance.

The future of reinsurance

We expect to see the following themes continue or arise over the remainder of 2024.

-

New entrant interest due to high demand: We anticipate that high demand for both longevity only and funded reinsurance from UK insurers will continue. This demand has led to more and more interest from new entrants, and we are helping a number of these reinsurers as they enter the market.

-

Persisting resourcing challenges alongside a search for efficiency gains: Reinsurers face human capacity constraints which could trigger focus on larger blocks of business or increased size limits on flow treaties.

-

Risk margin reform: The reduction in the risk margin came into force at the end of 2023. This has reduced the capital requirements insurers are required to hold in respect of longevity risk. It remains to be seen whether insurers' risk appetites or capacity for longevity reinsurance will be materially influenced by this regulatory change, or whether reinsurance pricing will continue to be too good to ignore. This is something we will be monitoring.

-

PRA focus: The PRA is concerned about the scale of demand for bulk annuities, and whether competitive pressures could create an environment where insurers build up systematic risk exposures through the use of funded reinsurance to counterparties whose risks may correlate with other market risks. They also have a focus on risk exposures to credit heavy reinsurers and the associated counterparty default risk. Both of these elements could reduce the appetite for funded reinsurance, although we have not yet seen this in practice.

-

Increased appeal for international market: The international pension risk transfer (PRT) market is a growing area of focus for reinsurers, and we have seen a number of very large reinsurance transactions in the US, Netherlands, and Asia. There is a question as to whether the opportunities in the international markets continue and take away from the already limited resource dedicated to the UK PRT market.

Conclusion

Reinsurance has many uses in the UK PRT market, with capacity and innovations helping the market to grow and thrive in recent years. The data suggests that use of longevity reinsurance by insurers has reduced since 2019. There are a number of factors, such as continued demand for funded reinsurance, competitive pricing, increased appeal from new entrants, and regulatory changes, which may determine whether this trend will continue.

Hymans Robertson has significant experience advising insurers and reinsurers in the UK PRT market. If you would like to discuss any of the topics in more detail or how we can support you, please get in touch.

This blog is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.