In recent blogs, we have set out ways that Collective Defined Contribution schemes can offer benefits to savers, along with associated risks to navigate. If implemented effectively, pooling risk across investment, longevity, and funding1 could target smoother and increased income levels for members, and Canada provides multiple examples of how this can be structured in varying ways2. But implementation isn’t easy, with the Dutch experience demonstrating that CDC arrangements need to feel simple and fair3.

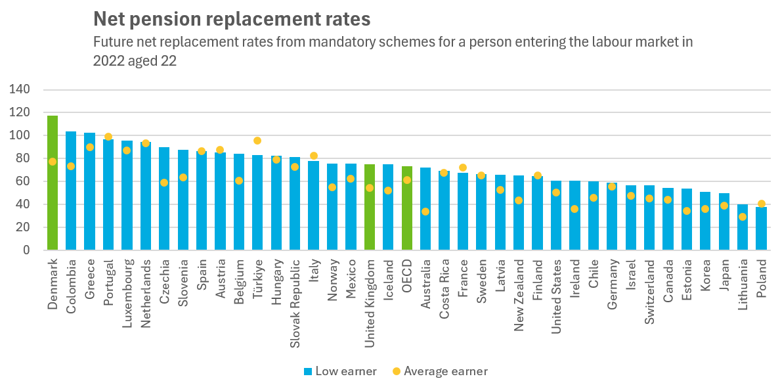

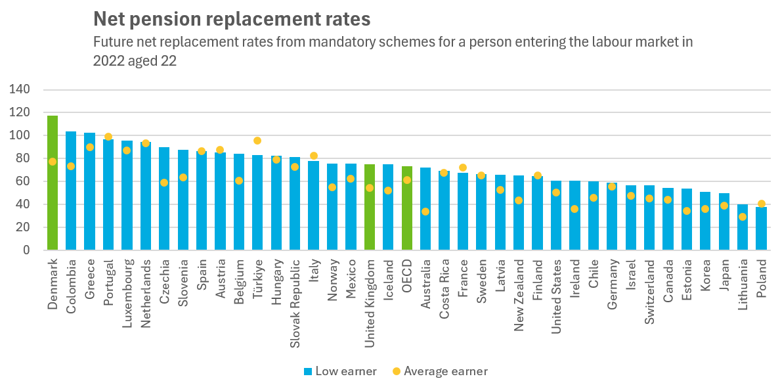

We were heartened that in the King’s speech, the goal of improving pension outcomes “so people have a pension and not just a savings pot when they stop work”4 was firmly on the table. CDC is designed to deliver exactly this - a pension, not a pot. In that light, we will take the opportunity to learn from Denmark, which is projected to deliver the highest level of replacement income for low earners through mandatory and state schemes in the OECD.

(Public Pensions - OECD)

In a great state... an overview of the Danish pension system

Broadly, there are three categories of pension provision within Denmark, statutory pension, labour market/occupational pensions, and individual pensions. Within this, one particularly interesting scheme is the Arbejdsmarkedets Tillægspension (the ‘ATP’).

The ATP is 60 years old, and participation in the scheme is mandatory for any employee between the ages of 16 and 67, working more than 9 hours per week5. The total value of assets in the scheme are DKK 710bn6; approximately £80bn. Contributions vary only by hours worked (not by level of income), and are split 2/3rd employer, and 1/3rd employee. From 1 January 2024, the total annual ATP contribution was DKK 3,5647, or around £400.

(Management of ATP Livslang Pension - Lifelong Pension)

The benefit that members receive from the ATP are a combination of a guaranteed pension income stream, plus the distribution of bonuses depending on the size of asset pool relative to projected liabilities - effectively a CDC structure. The pension commencement age is linked to the broader state pension age, which in turn is explicitly linked to indexation of life expectancy.

The ATP sits in the intersection between a state pension and an occupational pension. Indeed, there are some parallels between the ATP and the UK’s historic State Earnings-Related Pension Scheme, but there are some key differences too. The mandatory nature of ATP, and the level contribution structure, fosters a sense of equality, and the with-profits like bonus features and longevity indexation helps ensure it remains sustainable.

One point of detail around the ATP, is that much like contributions don’t vary by income level, expected benefits don’t vary by socio-economic status – they are based on an average life expectancy assumption. As such, from an actuarial perspective, there is a regressive ‘cross-subsidy’ from members with lower life expectancies, to (typically more well off) members with higher ones. On the other hand, with employee contributions in the region of £11 per month, a projected (additional) pension of c£2,900 p.a.8 for members contributing through their full working life is a great statutory benefit to help improve retirement outcomes for the lowest income individuals in the Danish society.

What are lessons for the UK?

Three points we could take from the Danish pension system are:

-

Building in risk sharing can aid sustainability - There are ‘safety valves’ to ensure the Danish pension system does not become underfunded, like the bonus system and the longevity indexation. Allowing for these from the outset can help set expectations and enable sustainability, avoiding painful ‘cliff edge’ adjustments to areas like state pension age, which fosters uncertainty and distrust.

-

CDC can play a part in state pension arrangements - CDC is primarily seen as an option for occupational pension schemes, but the existence of ATP shows there may be a broader role it can play within wider pension systems, and that reality is more complex than a neat segregation between occupational and statutory schemes.

-

There’s value in ‘all being in it together’ - In order to unlock the benefits of longevity and investment pooling, you don’t need a scheme of the scale of ATP. However, there are other benefits to this togetherness, such as a sense of solidarity and citizenship, avoiding selection effects, and a mechanism to alleviate poverty in the pensioner cohort of society.

Maybe as the labour government translate the intent of the King’s speech to action and legislation, there are some nuggets they can take from across the channel!

1 Collective what? - Hymans Robertson

2 Longevity Pooling - Yes you Can(ada)

3 Going Dutch: are risks better shared?

4 King's Speech 2024

5 Pensions system in Denmark

6 Quarterly report for Q1 2022

7 Employer ATP Livslang Pension

8 From payslip to payment - ATP

This blog is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.