Following the latest release on cancer diagnosis and survival figures in England, we look at what the data reveals about the changing nature of cancer and consider what it means for customers and providers of critical illness policies.

What we already know about cancer

Cancer prevalence has increased in recent decades with more than 360,000 new cancer cases in the UK every year[1]. In fact, one in two people are expected to develop cancer at some point in their lives[2]. Thankfully cancer research has developed immensely over the last few decades and due to improvements in diagnoses and treatments, UK cancer survival has doubled over the last 40 years. It means at least half of those diagnosed will survive the disease for more than 10 years.

The good news is that research also estimates that 40% of UK cancer cases can be prevented[3] by living heathier lifestyles through changes in our behaviours.

Nevertheless, cancer will continue to be a very prevalent disease. When it comes to cancer, and its treatment, timing and the type of cancer matters. Breast cancer is the most common cancer for females, followed by prostate cancer for males. This is also reflected by critical illness claims from most protection providers. Breast cancer made up 53% of female cancer claims for Aviva’s critical illness cover in 2018[4] and prostate cancer made up 20% of male cancer claims.

Cancer is typically categorised into four stages to denote its severity, with stage 1 meaning it is relatively small and contained within one organ. Stage 2 is larger but has not started to spread to surrounding tissue. Stage 3 means it may have started to spread to surrounding tissue, while stage 4 means it has typically spread to a second organ. Breast cancer which has been diagnosed in its early stages is usually easier to treat and has the best chance of being cured. This has led the NHS to develop initiatives such as the NHS Breast Screening Programme to find and treat cancer as early as possible.

What the latest figures show

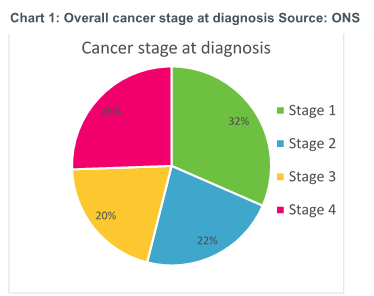

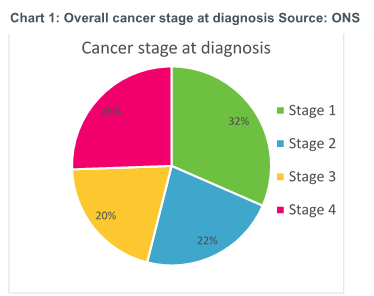

Chart 1 shows the percentage of cancers diagnosed in UK adults in each of the stages of progression from the recently published ONS data set on cancer survival[5]. Over 55% of the cancer cases in the UK were diagnosed at stage 1 or stage 2, the earlier stages of cancer before the cancer grows and spreads to be classified as stage 3 or 4.

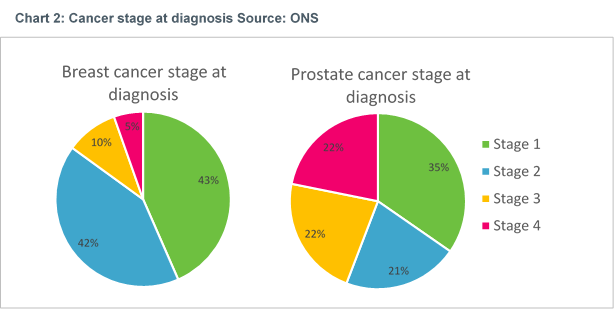

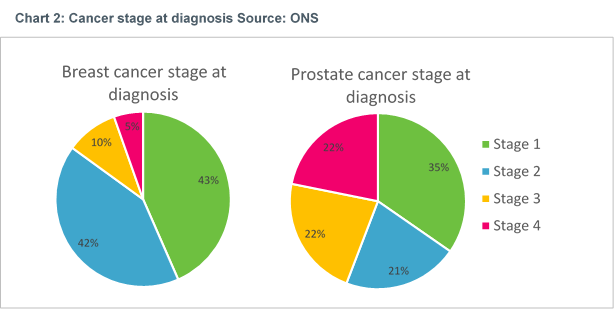

Interestingly, we see a different picture when we look at just breast cancer and prostate cancer. Chart 2 shows that the vast majority of breast cancer diagnoses (85%) are at stages 1 and 2, much more than the 56% of prostate cancer cases diagnosed in stage 1 and 2. This contrast between breast and prostate cancer, is likely partly due to the NHS Screening Programme for Breast cancer and partly due to the visibility of the cancer site.

Treating cancer

There are various treatments available depending on the nature and location of the cancer, with radiotherapy, chemotherapy and surgery among the most typical treatments. But how common is each treatment?

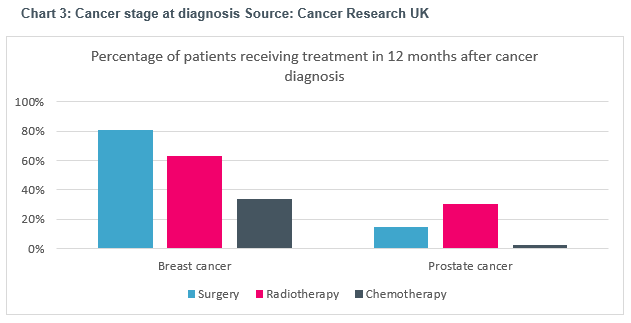

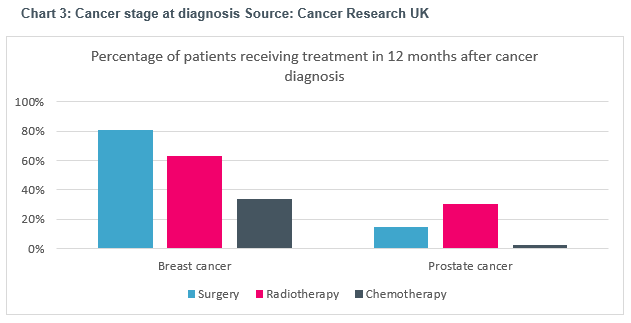

Chart 3[6] above shows the proportion of patients diagnosed at all stages with breast or prostate cancer, and who receive one of the three traditional types of treatment. We can see that over 80% of breast cancer patients undergo surgery, and many may also receive radiotherapy or chemotherapy too. For prostate cancer, only 15% of prostate cancer patients have surgical treatment, with radiotherapy being the most common treatment at 30% of all patients receiving this form of treatment. The low surgery rates are partly due to the slow progressing nature of early-stage prostate cancer and the fact that for many patients, early-stage prostate cancer does not cause any symptoms or issues, and invasive surgery is not judged necessary. By contrast, breast cancer is more easily operated, and surgery can provide an effective way of preventing the cancer from spreading through neighbouring soft tissue.

Therefore, while breast cancer is usually diagnosed earlier than prostate cancer, the treatment plan is often more invasive in nature.

The impact of treatment

Besides the physical and emotional impact of treatment, it can have various practical impacts which have financial implications. For example, treatment may mean needing to take time off work to go for treatment which can lead to a loss of income. As treatment progresses, the side effects may mean the patient has to take more time off work or stop work entirely. Besides loss of income there may also be additional costs, such as travelling to medical appointments and the need for additional child care.

In 2013, Macmillan Cancer Support found that 83% of those diagnosed with cancer are financially affected, and those who are affected are on average £570 a month worse off because of their cancer diagnosis. Understandably, the financial burden of diagnosis will vary depending on income at the time of diagnosis, where you live and what kind of cancer is diagnosed (cancer site and stage of advancement).

Critical illness policies over time

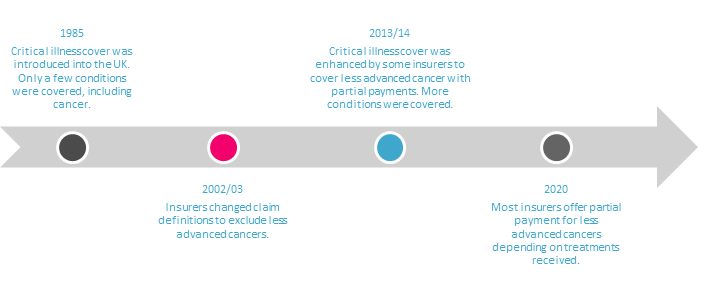

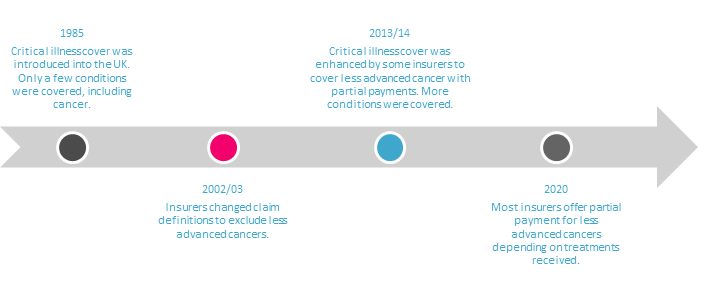

Although cancer has changed significantly in recent times it’s important to understand how this compares with changes in critical illness cover. Since its launch in the UK in 1985, critical illness cover has typically covered serious conditions that can lead to a significant financial impact and pays out a cash lump sum to help cover some of those costs or reduce debt.

The number of conditions covered by critical illness policies has changed over time. For example, in 1999 Aviva’s critical illness policies covered only 21 conditions. This is less than half of the 54 conditions covered by Aviva in 2014. By 2016 Vitality Life’s version of critical illness insurance covered 174 conditions. This story suggests, on the face of it, that an individual who still holds a policy they bought in 1999 may be better off re-broking their policy to have more conditions covered. However, the evolution of claim definitions tells a different story.

Around 2003, after the ABI changed its model cancer definition for critical illness policies, large critical illness providers excluded less advanced cancers from their cancer definition. However, recognising that this new definition was leading to a number of cancer claims being declined, there was a move in the market to introduce new partial pay-outs for less advanced cancers which began around 2013, typically paying around 25% of the full sum assured.

Partial pay-outs for less severe conditions are dependent on the exact policy conditions. For early-stage breast cancer, most critical illness providers will pay out 25% of sum assured if the patient undergoes surgical treatment to remove the tumour. For early-stage prostate cancer, some policy conditions require certain types of treatment to meet the claim definition, such as prostatectomy, external beam or interstitial implant, whereas other policies will pay out as long as prostate cancer was diagnosed, regardless of treatment method.

Reducing customer inequality

The changes in cancer treatment and critical illness policies over time means that there are potential areas of inequality between different groups of customers.

One area of potential inequality is between different generations of customer. A customer with a policy bought prior to 1999 is likely to be paid the full sum assured if they are diagnosed with low grade prostate cancer. A customer with the same condition would likely receive no pay-out if they bought their policy five years later in the mid 2000’s, but a customer who bought a policy in the last five years or so will likely receive a partial pay-out. Although customers who bought in the mid 2000’s could potentially get better cover by re-broking their existing policy, they will be re-underwritten, and risk higher premiums or exclusions being added, and so may not end up being better off. Customers who bought their policy in the 90’s may also re-broke their policy without fully appreciating the difference in cover between the two policies, leaving them potentially worse off if they make a claim. However, measuring equality between customer groups is not just about comparing breadth of policy definitions. To compare the value between different groups of customers, it’s important to consider some of the other drivers of value and how they have changed over time. This includes changes in the competitive landscape and how ‘hard’ or ‘soft’ premiums were at the time of purchase. For example, an older policy with relatively less cover sold at very competitive market rates may still provide more customer value than a newer, comprehensive policy sold at less competitive market rates. Another driver of value could also be access to additional benefits and services, such as virtual GP services, which are a relatively recent addition to critical illness polices and that may not be available to older policyholders.

While advisers can help customers think about the value they get from their critical illness policies, should insurers be doing more to help customers understand what they have, and proactively identifying those customers who may benefit from buying up the latest policy upgrades (or indeed offering any upgrades to existing customers for nothing)? Likewise, are checks in place to warn customers when they re-broke to a new policy what they may be giving up? Insurers may benefit from reviewing their historical critical illness policies to understand potential conduct risks, differences in policy value for each customer group, and any remediation strategies they can take to improve customer outcomes.

Matching impact with pay-outs

The evolution in treatment since some policies were written means that there could be a growing misalignment between the severity of the impact cancer has on the customer, and the financial pay-out they get from a policy (which is typically 25% or 100% of the full sum assured). Given there are so many different types of cancer and different treatments paths, it is almost impossible for a critical illness policy pay-out to be aligned perfectly with the likely financial impact of every cancer case. However, the latest data suggests there could be some changes made to ensure the policy pay-outs are better aligned with the impact cancer has. We have seen in the latest cancer figures that breast cancer typically results in more invasive treatments, yet the pay-out by some policies does not recognise this. Instead, could pay-outs be more closely aligned with the treatment, so that there is a pay-out every time there is a course of radiotherapy or surgical procedure. Should there also be a small pay-out on diagnosis of cancer, regardless of severity and location of the cancer, to help cover the likely cost of travel to hospital appointments? We have already seen some insurers create a diagnosis benefit to address some of these short-term needs, and we may see more follow suit.

What should insurers do?

The latest cancer figures reveal the ever-changing nature of cancer and the potential impact on customers. It highlights the need for insurers to think carefully whether critical illness policies are continuing to meet customer needs or would benefit from re-designing some of the claim pay-out triggers. It also shows the importance of future proofing policies as far as possible and considering the unintended consequences of continually developing products on equality between different generations of customer.

If you would like to discuss your product development plans or any of the issues in this article, one of our consultants would be happy to discuss with you.

[1] Cancer Research UK. Cancer Statistics UK. [online] Available at: https://www.cancerresearchuk.org/health-professional/cancer-statistics-for-the-uk [Accessed 20 Jan. 2020].

[2] Ahmad, A., Ormiston-Smith, N. & Sasieni, P. Trends in the lifetime risk of developing cancer in Great Britain: comparison of risk for those born from 1930 to 1960. Br J Cancer 112, 943–947 (2015) doi:10.1038/bjc.2014.606

[3] Cancer research UK. Causes of Cancer. [online] Available at: https://www.cancerresearchuk.org/about-cancer/causes-of-cancer [Accessed 20 Jan. 2020].

[4] Aviva Life & Pensions UK, 2018 Critical illness claims at a glance. [online] Available at: https://www.aviva.co.uk/adviser/documents/view/pt15951c.pdf [Accessed 20 Jan 2020]

[5]Office of National Statistics, 2019. Cancer survival in England: adult, stage at diagnosis and childhood - patients followed up to 2018. [online] Available at: https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/conditionsanddiseases/datasets/cancersurvivalratescancersurvivalinenglandadultsdiagnosed [Accessed 10 Dec. 2019].

[6] National Cancer Registration & Analysis Service and Cancer Research UK: "Chemotherapy, Radiotherapy and Tumour Resections in England: 2013-2014" workbook. London: NCRAS; 2017.