Our latest modelling suggests that an effective corporate ‘endgame strategy’ can reduce best estimate cash costs by 30% compared to expected Fast Track requirements from the Pensions Regulator.

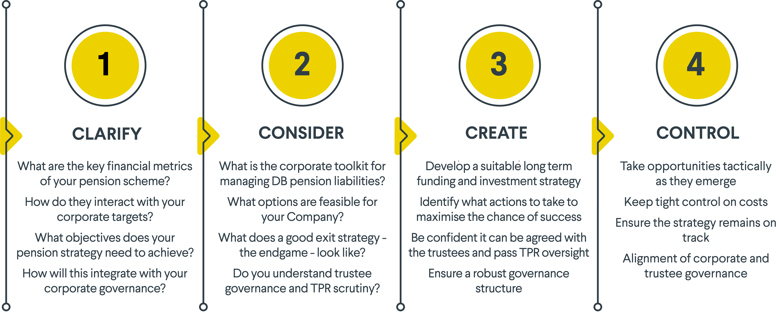

Using our four stage process 'the 4 Cs' , our team of experts help corporate sponsors of schemes to develop and deliver a focused strategy that allows them to successfully progress towards their specific long-term objective, whether that’s buy-out, self-sufficiency or a commercial consolidator.

For those scheme sponsors who have already developed an endgame strategy, we have produced materials and guidance to help optimise that strategy.

This page has been designed as a toolkit for corporate sponsors, with a range of useful resources available including webinars, analysis and guides. If you'd like to speak to our team about developing your own strategy please get in touch.

The 4 Cs process

Corporate endgame planning resources

For a company which sponsors a defined benefit scheme, having an effective pension strategy in place to see the scheme through to its end really matters.

The first stage is Clarify. Like any good strategy, the company needs to start by articulating the problem that needs to be solved.

The second stage is Consider. Once a company has clarified the objectives for its endgame strategy, it needs to understand the “tools” available that might help deliver those objectives and therefore form part of the endgame plan. The good news for companies is that the range of tools available to help manage DB schemes has never been greater. The bad news is that this can become quite bewildering! Without a smart consulting process, there is a risk that something that can really help ends up being overlooked.

The third stage is Create. By this stage the company has:

- Clearly articulated set of objectives and associated beliefs that the final strategy must support.

- Clarity on the range of tools that can realistically help with delivery of the strategy.

- An understanding of what any future governance framework needs to manage and achieve.

- A view on the ultimate exit strategy for the scheme.

In this stage, we help the company to implement a sensible and proportionate monitoring framework, along with a suitable governance structure.

ABC plc sponsored a defined benefit scheme which had been closed to future accrual for a number of years. The company had a very strong covenant but the trustees had a range of powers, including the ability to set contributions without the company’s agreement. There was a very good relationship between the company and the trustees, with the trustees respecting the company’s views and wanting to work with them wherever possible.

In this analysis, we assess effective endgame strategies for a range of illustrative companies.

This guide has been produced to help companies understand how they can avoid sleep walking into a ‘de facto’ buy-out and decide whether they should be aiming for their DB pension scheme to target buy-out as soon as possible, or opt for a longer-term run-off strategy.

If we take a look at the defined benefit schemes over the last 10 years that have successfully implemented their endgame strategies, they all share some common features, irrespective of their specific strategies or ultimate objectives. Discover what those features are and how to improve your DB endgame.

Corporate DB endgame strategy webinars

Watch our series of webinars which are all intended to help corporate sponsors develop and then implement a comprehensive DB endgame strategy.

Understanding what you need from your corporate DB endgame strategy

In our first webinar, our experts will explain why sponsor companies need an endgame strategy and talk through the steps and process you should be considering to help deliver an effective strategy.

Opens in new window Watch on demand

Consider and Create: Developing and implementing your corporate DB endgame strategy

Leonard Bowman and Saher Asmat explain the steps corporates should consider to develop and implement a successful DB endgame strategy.

Opens in new window Watch on demand

Control: Monitoring and governance of your corporate DB endgame strategy

Our experts talk through how companies can integrate monitoring their endgame strategy and decision making into their ongoing corporate governance framework.

Opens in new window Watch on demand

Awards and accreditations

Talk to our team

Contact our team today to learn how we can help your business make better risk and people decisions.

Get in touch

Find an expert

With experts across pensions, benefits, insurance, and digital, find the right person to support you.

Search experts