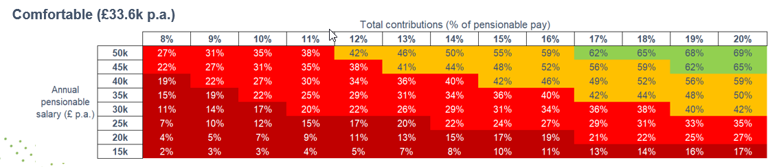

High earners need to contribute 20% to DC schemes to achieve PLSA ‘Comfortable’ Retirement Living Standard

-

Those earning less than £40k unlikely to reach the PLSA ‘comfortable’ Retirement Living Standard without significantly increasing contributions

-

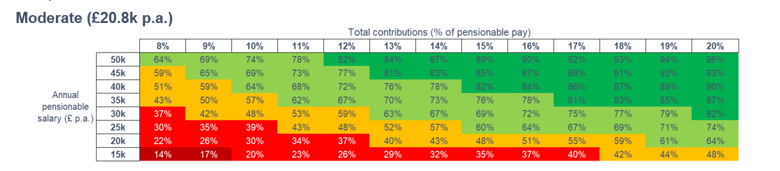

Even the PLSA ‘moderate’ Retirement Living Standard looks out of reach for many

-

Employers must encourage employees to save more into pensions

-

Government must increase AE contribution targets to help avoid pensioner poverty

Annual DC pension contributions of a staggering 20% are needed for those earning £45k or more to reach the ‘comfortable’ [£33,600 per annum] level of the PLSA Retirement Living Standards according to analysis by Hymans Robertson in its latest research. Even the PLSA’s ‘moderate’ level appears unattainable for many, without an increase in contributions, the leading pensions and financial services firm warns.

The research found that most DC pension scheme members are likely to meet the PLSA Minimum Retirement Living Standard [£10,900 p.a.] with the current minimum total contribution rate of 8% under auto-enrolment, assuming they are entitled to the full State Pension. However, the PLSA’s moderate standard, [£20,800], looks to be out of reach for the majority of auto-enrolled members, reveals the leading pension and financial services consultancy in its latest research.

The firm used its Guided OutcomesTM modelling to calculate the chance of meeting each of the PLSA standards for different combinations of salary (from £15k to £50k) and total contribution rate (from 8% to 20%). The results are categorised using a colour scale of red (very unlikely to achieve the standard), amber (moderate likelihood), and green (high chance of achieving the standard).

The picture for low earners (those earning £15,000 or less) looks particularly bleak; even with high contributions, they have little chance of reaching the moderate standard. Those earning £30,000 can give themselves a good chance of meeting this standard, but only if they are contributing at least 13% - far more than the current AE minimum total contribution rate of 8%.

For those hoping for a comfortable retirement, significant change is likely to be needed. Even higher earners (those earning £50,000) would need to contribute nearly a fifth of their salary (17%) to meet the comfortable living standard. Those who choose to make only the minimum auto-enrolment contributions of 8% are highly unlikely to have enough in their pension pot at retirement to achieve the ‘comfortable’ standard.

Commenting on the findings, Darren Baillie, Lead Digital Consultant for DC Pensions, Hymans Robertson, says:

“Our research paints a worrying picture for pensioners and future pensioners. The PLSA Retirement Living Standards are a guide to the level of spending required to fund different standards of living in retirement. The expected standard of living of many members will not be met without significant, and costly, changes. While our analysis provides a stark warning to DC scheme members about the potential inadequacy of their contributions, we know many are struggling with the cost-of-living crisis. Increases in energy bills and mortgage payments are likely to result in pension contributions being pushed further down the savings priority list.

“It’s vital that government does more to help. We would like to see an overhaul of the current auto-enrolment legislation, with much more done to encourage individuals to forward plan and invest in their pension, even during challenging times. We continue to call for the AE minimum total rate to be increased to 12% and would urge the new pensions minister to add this to the top of their to-do list.

“We would urge employers to do all they can to ensure their members are aware of the importance of contributions and provide support to help them set realistic and achievable retirement income targets. Furthermore, providing members with the means to monitor progress against their targets and understand how their goals can be achieved is vital in helping a generation avoid a rude awakening in retirement.”

A copy of the Helping Members Achieve Retirement Goals report can be found here.