Getting all the way to buyout is a bit like a journey to the moon. You’ve spent most of the time moving towards it, but over the last couple of years it’s got much closer and now it’s time to begin your descent - you don’t want to under or overshoot your landing zone. Read on to find out why this could be easily done and how you can improve your funding target to ensure a smooth and safe landing.

Why your buyout cost may be lost in translation

You’ve decided that buying out is your pension scheme’s objective. The only way to find out the exact buyout cost is by asking the insurance market for quotes.

Of course, it’s not possible to do this regularly (and even if it was, it would be expensive). Insurers carefully select the schemes they price for, testing that each scheme is serious about buying out so as not to spend limited resources on speculative exercises.

Instead, to support strategic decisions and monitoring, schemes use a proxy buyout funding basis, that is often constructed using a “Gilts +” approach to set discount rates. For example, “Gilt yield curves with 0.3% p.a. addition” might be a proxy for the buyout cost of pensioner liabilities.

Does that sound familiar? If it does, it’s because “Gilts +” is the language of pension schemes, it has little use in the insurance market. Insurer pricing uses a different language, “swaps + credit”.

We’re not criticising “Gilts +”, it serves schemes well when buyout still feels like a moonshot; it’ll take you in the right direction. But when you have the moon in sight and you’re attempting to land, as many schemes now are, “Gilts +” could create a very bumpy landing or worse still, cause you to miss your objective.

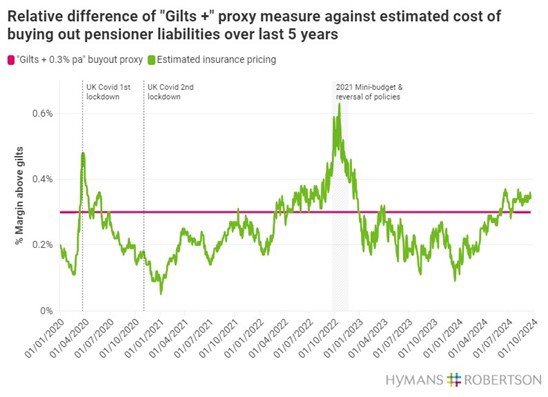

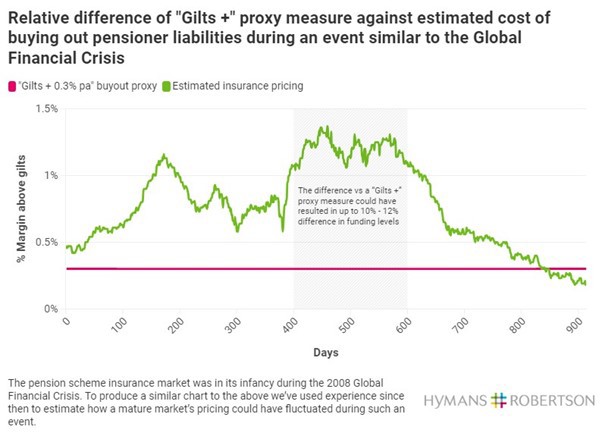

The cost of speaking different buyout languages

That’s because the “Gilts +” translation of “swaps + credit” is highly volatile compared with reality on the ground. To see this, we’ve shown the relative variation between a “Gilts +” buyout proxy (flat [red] line) compared to insurance market pricing (estimated from market deals and other information) for pensioner liabilities. The first chart spans the period from the Covid pandemic, the Conservative mini budget in 2022 and up to summer 2024. The second chart is an estimate of the difference during an event like a Global Financial Crisis. As you can see, insurance market pricing fluctuates significantly above and below a fixed “Gilts +”. It’s particularly volatile during market crises.

Click to view interactive version.

Click to view interactive version.

In calm markets the difference could be a few percent in terms of funding levels, which could still be tens or hundreds of millions of pounds, depending on the size of your scheme. In stressed markets it could be as much as 5 times more. Your proxy funding measure could end up missing your objective by more than your annual risk budget. As the difference isn’t constant either, there is a risk of:

-

Schemes approaching the market prematurely, thinking they are close but in reality needing their sponsor to write a large cheque.

-

Failing to turn off sponsor contributions, leading to all the complications and costs that come with a surplus on buyout and wind up.

That led us to ask: why are schemes targeting and tracking a measure that doesn’t respond dynamically to the key drivers of insurer pricing and could deviate significantly from pricing in the market? Why aren’t pension schemes using the same language that insurers use if that’s the real cost of buying out?

How to speak the same language to measure buyout funding

The answer is because it’s hard to really get inside how insurers price. Hard, but not impossible.

We’ve taken full advantage of the experience in our Risk Transfer team, where four senior members held senior roles at leading bulk annuity insurers (and with 40% of the value of market deals completed so far this year under our belts), to innovate and resolve this issue.

We’ve created a yield curve to value pension scheme liabilities which speaks the same language as the insurance market – “swaps + credit”. Our Dynamic Annuity Pricing Curves (DAPCs) allow for a range of factors such as credit spreads, scheme size and maturity. A multi-disciplinary governance team overseas the DAPCs to ensure their effectiveness in all market scenarios.

Our DAPCs now drive our buyout funding measurements, tracking the [green] lines in the charts. Layer on Club Vita longevity assumptions (as used by 75% of primary insurers) and you have a buyout informed funding measure that allows schemes to land their buyout deal with confidence and precision. With unnecessary noise removed from their strategy, trustees and sponsors can have much higher confidence in:

-

Making and monitoring strategic decisions, even during volatile market events.

-

Knowing when to approach the insurance market for quotes.

And it’s not just for schemes with a buyout objective. If you’re thinking of running on instead of buying out, having a safe ‘pivot point’ – a plan B - such as buyout in case circumstances change is hugely important. Our DAPCs will be equally helpful to shape and monitor your run on strategy by benchmarking against a better estimate of buying out.

If you want to know more or get your scheme to track a buyout measure you can rely on, please contact Laura McLaren, Tim Wanstall or Jonathan Seed.